Concern for climate

The current economic development policy of the EU places particularly strong emphasis on climate issues, specified in the European Green Deal and ancillary documents, which in effect signifies the requirement to transition the industry towards a low-emission economy. As a producer of direct and indirect greenhouse gas emissions in connection with the nature of our business and value chain, we are committed to the implementation of the objectives of the Paris Agreement and the European Green Deal. We want to reduce our carbon footprint and take the journey to climate neutrality.

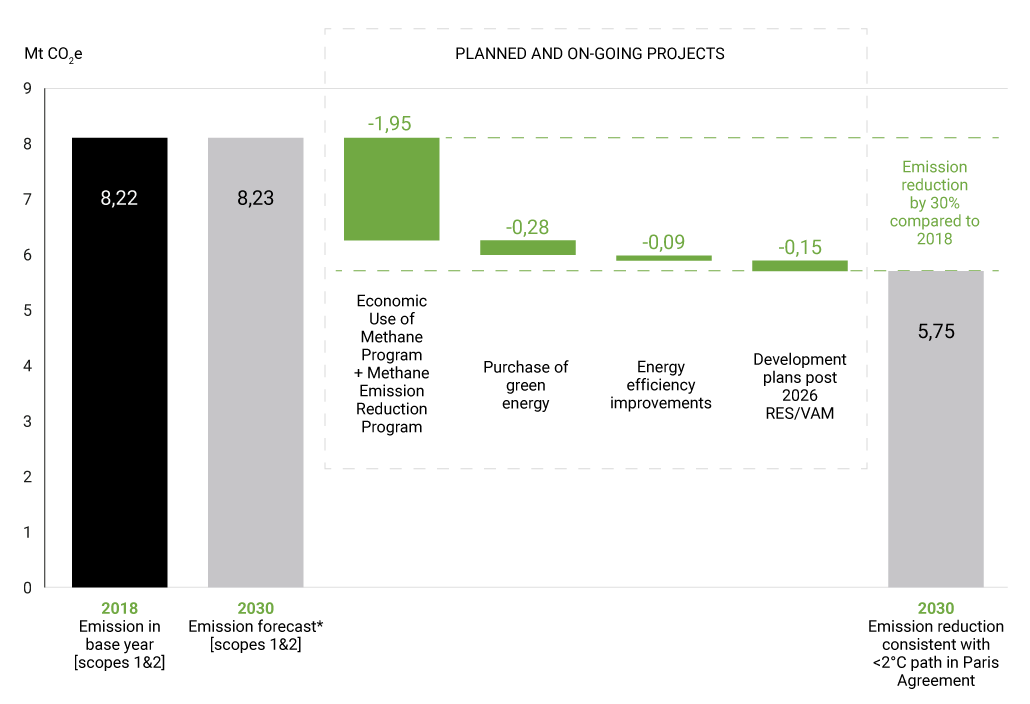

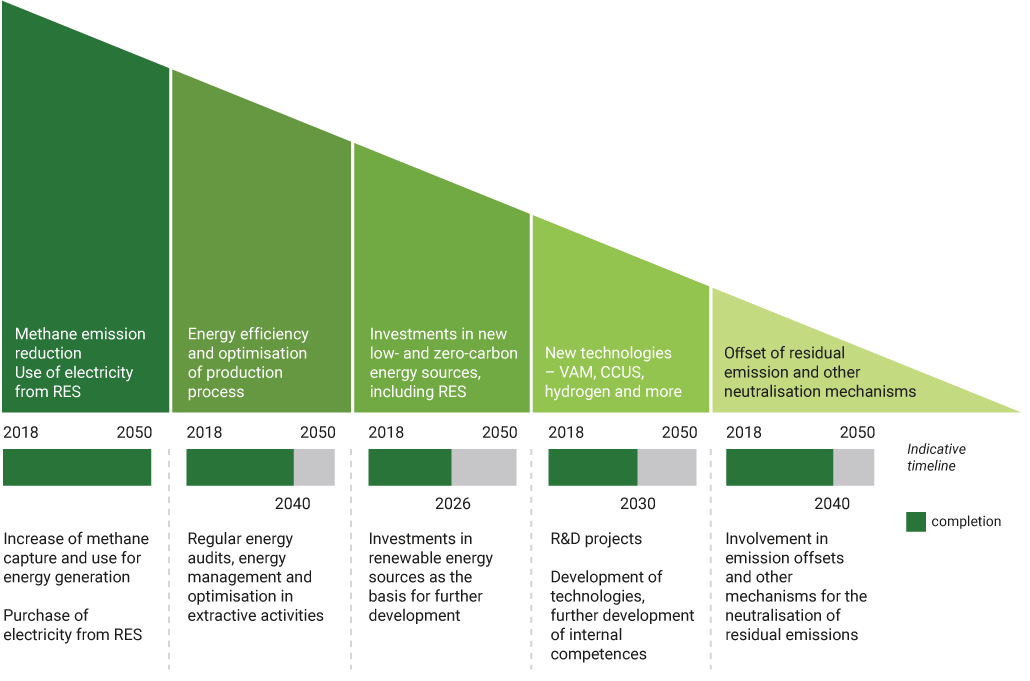

In the Group’s Environmental Strategy 2022-2030 we have adopted as a strategic objective to reduce our GHG emissions - carbon footprint (Scope 1 and 2) by 30% by 2030 relative to 2018 in line with the Paris Agreement and to aim to achieve climate neutrality no later than by 2050.

In 2021, JSW initiated the process of developing the JSW Group's Environmental Strategy until 2030 with an Outlook until 2050, the main element of which is the Group's climate policy. On February 2022, the Supervisory Board adopted a resolution to approve the JSW Strategy including the Group’s Subsidiaries for 2022-2030, adopted by the Management Board, with the Environmental Strategy as its an integral element.

Key assumptions of the Environmental Strategy:

The Environmental Strategy is based on changes in the external environment and the Group's experience

External and internal factors influencing the Group’s priorities

| TRENDS |

|

| MARKET |

|

| REGULATIONS |

Evolving regulatory environment, financial support for pro-environmental projects, including:

|

| EXPERIENCE AND COMPETENCES |

|

JSW Group's key plans in the environmental area until 2030

Taking a responsible approach and applying the highest environmental standards and adopting climate targets consistent with the Paris Agreement

Air protection and emissions reduction

Reduction of emissions to air

- Adoption of GHG reduction targets consistent with the Paris Agreement

- Adaptation of plants to environmental best available technology (BAT) emission requirements

- Further optimisation of energy consumption and use across JSW Group's operations

- Search for partners to develop own renewable energy capacity

Continuous monitoring of emissions and efforts to reduce greenhouse gas emissions using the best available technologies in line with Polish and EU climate targets

Aim of developing a circular economy

Optimal management of extractive waste

- Reduction in the amount of waste generated

- Planning and developing improved waste management options

- Producing and selling mine rock aggregates

Minimisation of waste streams, continuous monitoring of waste from production processes and its segregation

Land rehabilitation

Resources and land rehabilitation

- Examining the possibilities for limiting emissions from mining operations

- Carrying out land rehabilitation along with the progress of longwall works

- Rectification of mining damages

Carrying out activities in the field of rehabilitation and management of areas transformed as a result of mining activities in order to restore them and to restore their natural and landscape values

Respect for water and biodiversity

Protection of water and biodiversity

- Rational water management

- Care for the quality of water discharged into the environment

- Minimisation of impact on water and biodiversity

- Support for the protection of biodiversity

Effective water management and operating with respect for biodiversity

JSW Group carbon footprint: GHG emission reduction targets

Existing initiatives and commitments

Air protection and emissions reduction

COMMITMENT: JSW Group strives to reduce GHG emissions by at least 30% until 2030, compared to 2018 (at the level of <2oC in line with the Paris Agreement) and reach climate neutrality not later than 2050*

CLIMATE TARGETS

| KPI | 2026 | 2030 |

|---|---|---|

| GHG emission reduction in scopes 1&2* (compared to 2018) |

-27% | -30% |

| Methane capture | up to 50% | Update in 2024, after new methane content forecasts |

| Economic use of captured methane | >95% | >95% |

| Purchase of electricity from renewable energy sources (on top of energy produced and used internally) | 100% | 100% |

| Volume of energy savings (ground infrastructure) | 35 300 MWh | To be determined after the next energy audit |

ACHIEVEMENTS AND ON-GOING ACTIVITIES

- Capture and economic use of methane to produce energy - currently approx. 86 million m3 of methane annually, which is equal to approx. 1.73 million Mg CO2e.

- Implementation of energy project "Economic use of methane" (expansion of generating capacities) 48 MW

- Modernisation of coking batteries

- Construction of 28 MWe energy unit

- Energy efficiency improvements

- Modernisation of air conditioning systems

- Investments in photovoltaics

JSW Group carbon footprint: 30% emission reduction by 2030 based on strategic initiatives

Initiatives incorporated into the Group's business plans

2026 target

The principal objective is to reduce emissions by 27% already by 2026, compared to base year 2018), which will be achieved by the Group thanks to planned projects and using known and available technologies.

STRATEGIC PROGRAMS

- JSW Group has been running the "Economic Use of Methane" program since 2018 with the aim of reducing methane emissions to air and its use in the production of energy.

- The second planned program aimed at reducing methane emissions is the "Methane Emission Reduction" program, intended to increase methane capture to 50% and methane use to 95%.

- In 2024, the Group lans to update its emissions forecasts and on this basis will adapt subsequent projects for the period 2026-2030 so as to achieve a reduction level consistent with the Paris Agreement.

DEVELOPMENT PLANS

- Further optimisation of electricity use

- Development of own RES capacities and search for partners to generate electricity from renewable sources

- Carrying out innovative development initiatives related to emission reduction - VAM, CCUS, hydrogen and more

* Emission forecast based on JSW's methane level forecast to 2026, developed in December 2021

GHG EMISSION FORECASTS AND REDUCTION PLANS

JSW GROUP CLIMATE TARGETS

As a supplier of a critical raw material, we see JSW Group's key role in the transition of the European economy toward climate neutrality

As JSW Group, we strive to reach climate neutrality not later than 2050, with an intermediate target of reducing the Group's carbon footprint by at least 30% by 2030.

(scopes 1&2, compared to 2018)

Environmental strategy in JSW Group's business model and its communications with the market

PLANNED EXPENDITURES UNTIL 2030 approx. PLN 4.3 billion

- Activities related to air protection, including adaptations to BAT requirements approx. PLN 3.7 billion

- Activities related to water protection approx. PLN 0.5 billion

- Activities related to rational waste management and land rehabilitation approx. PLN 0.1 billion

MANAGEMENT

- Assignment of responsibility for climate matters

- Expansion of the Environmental Emissions Team's activity

- Implementation of climate risk management into existing ERM system processes

COMMUNICATION AND REPORTING

High-priority approach to environmental and climate disclosures, including:

- Adaptation of ESG reporting to new requirements. Reporting in line with TCFD guidelines

- Readiness to disclose the level of scope 3 emissions from 2023

- Taxonomy reporting on JSW Group's business

- Participation in specialist ratings concerning ESG and climate

In connection with the nature of its activity, the Group has direct and indirect impact on climate changes:

DIRECT IMPACT on climate change results from mining and production operations:

- Greenhouse gas emissions related to the production process, mainly methane associated with the coal mining process (74% of the organization's CF value), carbon dioxide associated with the coking process,

- Greenhouse gas emissions associated with electricity and heat production,

- Fuel and energy consumption as part of conducted operations and the related greenhouse gas emissions.

INDIRECT IMPACT on climate change is mainly related to the processes of production and transportation of raw materials, materials necessary for production processes and transportation of manufactured products, energy intensity of the production process and management of mainly mining waste.

Climate change may influence the Group’s operations through unfavorable, variable weather conditions which may contribute to disruptions in mining, production and supply of products to business partners and in supplies of materials to the Group’s plants required for the production process. Drought may have a particular impact, which will prevent water withdrawals for production purposes and the discharge of saline water to surface waters. In addition, higher temperatures in the summer may affect the ventilation and operation of mine workings' air conditioning systems. Coking plants - as continuous operation plants, i.e. production processes that cannot be stopped without destroying the facility - are particularly exposed to weather changes. The increased unpredictability of atmospheric phenomena, observed for several years, and the reduced distinctiveness of individual seasons have been identified as one of the significant climate risks described below.

RISKS AND OPPORTUNITIES ASSOCIATED WITH THE CLIMATE

| RISK* | POTENTIAL NEGATIVE IMPACT ON THE GROUP | POTENTIAL POSITIVE IMPACT ON THE GROUP | POSSIBLE RESPONSE TO THE RISK (MITIGATING RISKS / EXPLOITING OPPORTUNITIES) |

|---|---|---|---|

| TRANSFORMATIONAL - TRANSITION | |||

| Implementing the European Green Deal and the FIT FOR 55 Package |

|

Possibility of subsidizing/financing activities related to the development of a low-emission economy (RES projects and other pro-climate technologies) |

|

| Increase in GHG emission charges and potential extension of the scope of the EU ETS to include methane |

|

Shift to low- and zero-carbon energy generation technologies |

|

| Energy transition related to the EU climate policy |

|

Increase in demand for construction materials – steel (coke) Development of innovative technologies, including hydrogen Increase in demand for energy from RES |

|

| Electromobility and development hydrogen technologies |

|

Increase in demand for hydrogen - an opportunity for the Group |

|

| Demand for modern materials, transition to CE |

|

Development of new materials, e.g. carbon composites |

|

| PHYSICAL | |||

| Increase in frequency of heat waves and drought periods; decrease in average summer precipitation |

|

Potencjalny wzrost popytu na stal (koks), Potential increase in demand for steel (coke), due to increased demand for building materials Increased demand for rock (mining aggregates) |

|

| Increase of extreme events (storms, winds, floods, fires) |

|

Cost attractiveness of products to European customers due to difficulties with overseas transportation Social involvement through helping the JSW Foundation |

|

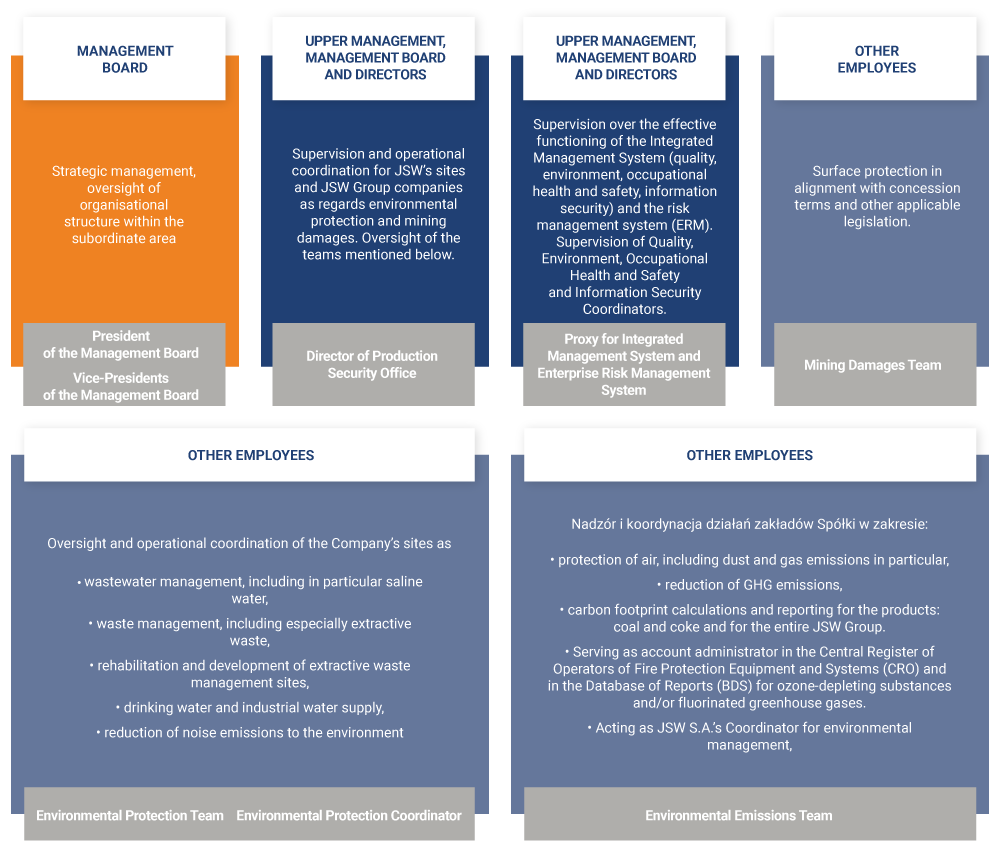

ROLES AND RESPONSIBILITIES ASSOCIATED WITH THE CLIMATE

As of 2018, all Group companies have designated individuals responsible for input data for carbon footprint calculations and environmental reporting. In the Parent Company, environmental issues are assigned to resources at the level of the Management Board, top management and other employees.

COMMITMENT TO REDUCTION OF CLIMATE CHANGE

The current economic development policy of the EU places particularly strong emphasis on climate issues, specified in the European Green Deal and ancillary documents, which in effect signifies the requirement to transition the industry towards a low-emission economy. As a producer of direct and indirect emissions of greenhouse gases in connection with the nature of our business and value chain, we are committed to the implementation of the objectives of the Paris Agreement and the European Green Deal. We are aware that our production processes cause high energy consumption and emissions into the air and water. We have to face these challenges in the near future and reduce them. The coking coal and coke we produce still continue to be the key raw material for the production of steel used in the creation and implementation of low-emission technology and infrastructure. To build a typical wind turbine uses about 180 tons of steel, which in turn requires about 100 tons of coking coal to produce.

|

In our approach to climate change, we try to follow international standards, including the guidelines of the Task Force on Climate-related Financial Disclosures. |

Since 2017, we have calculated the carbon footprint of the Group, which included direct and indirect greenhouse emissions involved in both the mining and coke production. The main source of greenhouse gas emissions from Group’s operations is methane, which is removed for safety reasons from mining pits (approx. 74% of the carbon footprint). The key to lower methane emissions is capturing and economic utilization to generate energy.

Since 2018, in KWK Budryk and KWK Knurów-Szczygłowice we implement an investment project entitled: “Economic utilization of methane” of the total project value of approx. PLN 300 million, designed to increase the share of in-house energy and reduce methane emissions and the carbon footprint by further 1.3 Mg CO2e. In 2021, we continued the Commercial Utilization of Methane program aiming to install new co-generation engines and increasing the use of methane and own production of energy. In 2021, it was possible to utilize approx. 99 million m3 of methane, i.e. 15% more than in 2020, which in terms of the CO2 equivalent allows to avoid emissions of approx. 2 million tons/year. The launched and successively implemented measure made it possible to reduce methane emissions by 16% in 2019-2021.

JSW KOKS S.A. implements environmental investment projects related to the use of coke oven gas for electricity generation. In the Radlin Coking Plant, an energy generation unit is under construction, of the capacity of 28 MWe. The excess coke oven gas will be used for production of electricity and thermal energy for internal use and for sale. The implementation of this project will reduce the Group's Scope 2 carbon footprint.

To respond to the high energy intensity of water desalination, the PGWiR company, involved in the management of saline water from JSW coal mines, plans to build a large photovoltaic farm of the capacity of 3.1 MWp in the area of the Dębieńsk Desalination Plant. The idea is for the green energy generated by the photovoltaic farm to power the Dębieńsk Desalination Plant, where mining water will be treated to the parameters of technological water, and then recirculated to be used in KWK Budryk.

In 2021, photovoltaic panels with the total capacity of approximately 0.1 MWp were installed at CLP-B and JSU. Currently, there are PV installations with the total capacity of ca. 0.8 MWp operating at the Group.

GAS AND DUST EMISSIONS

The main source of greenhouse gas emissions following from the Group’s operations is methane from the ventilation of mining pits (approx. 74% of total emissions, converted into CO2e) and carbon dioxide from fuel burning processes, mainly in the coke segment. Curtailing greenhouse gas emissions in the Group was accomplished by making the maximum energy utilization of gas through methane drainage in the mines. As a result of utilization of captured methane for production of electricity and heat in high-efficiency cogeneration systems, in 2021 the emission of methane into the atmosphere was reduced by approx. 99 million m3 (i.e. approx. 15% more than in 2020).

In the coke segment, execution of the strategic projects launched in 2019 – modernization of the coke oven battery in the Przyjaźń Coking Plant and construction of a power unit in the Radlin Coking Plant – will make it possible to maximize the use of coke oven gas and improve energy efficiency. Excess coke oven gas is used for production of electricity and thermal energy for internal use and for sale. In connection with the participation of JSW KOKS in the greenhouse gas emissions trading system in reference to carbon dioxide, the Group carries out estimations of the cost increase that it will have to incur in connection with the operation of its coking installations, heat generation plants and combined heat and power plants in the fourth settlement period of 2021-2030.

Carbon footprint

The Group is among the few groups in Poland that has been carrying out (since 2017) integrated estimation of the carbon footprint of the organization and two key products – coal and coke, based on the GHG Protocol standard using an implemented tool supporting the calculations. The calculations take into account emissions of the following greenhouse gases: carbon dioxide, methane and hydrofluorocarbons. The calculations were carried out in accordance with the GHG Protocol Corporate Accounting and Reporting Standard REVISED EDITION, based on the emission intensity indicators specific to energy suppliers (market based) and the GWP (global warming potential) greenhouse effect creation indicators published in IPCC Fifth Report from 2014 (AR5, The Fifth Assessment Report of the IPCC).

The scope of reported emissions (operational boundaries) includes scope 1 (scope 1, direct emissions) and scope 2 (scope 2, indirect emissions resulting from the generation of energy purchased by Group entities). Scope 2 emissions for all significant energy types were for the first time determined based on energy supplier-specific (market based) metrics.

Scope 1included direct emissions from sources located in all Group companies, comprising emissions:

- from burning of fuel in stationary sources

- emissions from technological processes, including: emissions from coking, emissions related to ventilation, emissions from creating cool air, emissions from other processes (e.g. welding)

- from burning of fuel in combustion engines,

Indirect emissions from scope 2 comprise emissions associated with generation of:

- electricity,

- heating,

- cooling,

- compressed air,

- purchased and consumed by Group companies.

No biogenic emissions were recorded in 2021.

The JSW Management Board decided to publish information on the organization’s carbon footprint. The carbon footprint of coal and coke products calculated in scopes 1, 2 and 3 upstream will be made available on the express request of the Group’s business partners for such products.

Due to the use of market-based rates for purchased energy for the first time, the base year 2017 was recalculated using the new rates. Scope 2 for the base year changed from 1.043 million Mg CO2e to 0.998 million Mg CO2e, and thus the value of the total carbon footprint for 2017 decreased from 8.14 million Mg CO2e to 8.10 million Mg CO2e.

| ORGANIZATION’S CF GROUP |

DIRECT EMISSIONS (SCOPE 1) |

INDIRECT EMISSIONS (SCOPE 2) LOCATION BASED | TOTAL EMISSIONS (SCOPE 1+2) |

||||

|---|---|---|---|---|---|---|---|

| EMISSIONS PER PRODUCT UNIT (COAL + COKE) | EMISSIONS PER PLN 1 MILLION OF REVENUE |

||||||

| YEAR | mln Mg CO2e | CO2 | CH4 | HFCs | m Mg/m Mg | m Mg/PLN m | |

| 2017 | 8,14 | 1,06 | 6,03 | 0,01 | 1,04 | 0,458 | 0,000917 |

| 2018 | 8,22 | 1,10 | 6,05 | 0,02 | 1,05 | 0,447 | 0,000838 |

| 2019 | 7,92 | 1,05 | 5,63 | 0,02 | 1,22 | 0,443 | 0,000914 |

| 2020 | 7,18 | 1,13 | 5,32 | 0,02 | 0,71 | 0,406 | 0,001027 |

| 2021 | 7,92 | 1,29 | 5,86 | 0,01 | 0,76 | 0,456 | 0,000745 |

Boundaries of the organization – approach to operational control – 100% of emissions from all Group companies

Operational boundaries – direct and indirect emissions in scopes 1 and 2 Due to the fact that both coal and coke constitute intermediate products in further processes, scope 3 in the organization’s carbon footprint was omitted.

In accordance with the methodology recommended by the GHG Protocol, uncertainty of the organization’s carbon footprint was set at 8%

To assess the level of emission intensity, the ratio of greenhouse gas emissions per unit of product (the sum of coal and coke production) and per unit of revenue is used at the Group level.

The share of JSW Group companies in the carbon footprint in 2021

In 2021, the Group’s total emissions within scopes 1+2 dropped by 2.2% compared to the 2017 base year, with emissions from scope 1 increasing by 0.9% and emissions from scope 2 decreased by 24%. Compared to 2020, there was a significant increase in direct emissions of both CO2 by 14.2% resulting from an increase in coke production and an increase in methane emissions by 10.1% resulting from an increase in methane emissions from the mined longwalls, which caused an increase in the methane content of the mines.

OTHER ATMOSPHERIC EMISSIONS

Other substances emitted mainly as a result of: burning of fuel in boilers, gas engines, combustion engines in means of surface and underground transport and machinery and equipment do not cause breaches of the permissible levels or benchmarks.

| OTHER EMISSIONS (JSW GROUP) (Mg) | 2021 | 2020 | GROWTH RATE 2020=100 |

|---|---|---|---|

| MASS OF OTHER SIGNIFICANT ATMOSPHERIC EMISSIONS, INCLUDING: | 8 244,6 | 6 478,0 | 127,3 |

| SOx | 1 846,3 | 1 390,0 | 132,8 |

| NOx | 3 001,2 | 2 352,1 | 127,6 |

| CO | 2 926,7 | 2 309,8 | 126,7 |

| Total dust | 470,4 | 426,1 | 110,4 |

| Other emissions per unit of revenue mg/PLN million | 0,78 | 0,93 | 83,9 |

USE OF FUELS AND ENERGY AT JSW GROUP

Use of energy sources at JSW Group

| ITEM | 2021 | 2020 | GROWTH RATE 2020=100 |

|---|---|---|---|

| Motor gasoline (litre) | 257 833,0 | 248 822,5 | 175 150,4 |

| Diesel fuel (ON) (litre) | 9 962 426,3 | 8 993 119,8 | 7 906 184,3 |

| LPG (litre) | 46 337,3 | 53 194,1 | 57 794,3 |

| Methane from mine drainage (m3) | 36 284 600,0 | 29 449 991,1 | 18 732 816,0 |

| Coke oven gas (m3) | 1 280 948 592,3 | 1 182 099 878,0 | 1 327 904 234,0 |

| Heating oil (Mg) | 146,8 | 40,6 | 57,4 |

| Hard coal (for energy purposes) (Mg) | 394,0 | 116,6 | 109,1 |

| Waste gas fuel (excess gas) (GJ) | 45 473,8 | 92 052,6 | 125 723,0 |

| Natural gas (m3) | 452 328,2 | 576 754,0 | 83 977,0 |

Use of energy sources at JSW

| ITEM | 2021 | 2020 | GROWTH RATE 2020=100 |

|---|---|---|---|

| ELECTRIC ENERGY (MWh) | |||

| Production | 949 031,1 | 929 142,7 | 102,1 |

| Purchase | 1 496 136,1 | 1 414 002,6 | 105,8 |

| Own use | 1 519 970,3 | 1 463 212,6 | 103,9 |

| Sale | 924 582,1 | 879 644,9 | 105,1 |

| HEATING (STEAM, HOT WATER) (GJ) | |||

| Production | 1 903 168,0 | 2 288 966,7 | 83,1 |

| Purchase | 1 598 918,2 | 1 421 551,7 | 112,5 |

| Own use | 3 469 989,7 | 3 682 051,6 | 94,2 |

| Sale | 32 096,6 | 28 466,8 | 112,8 |

| COOLING (GJ) | |||

| Production | 218 210,0 | 222 221,0 | 98,2 |

| Purchase | 230 804,0 | 209 186,0 | 110,3 |

| Own use | 449 014,0 | 431 407,0 | 104,1 |

| Sale | - | - | - |

Zużycie energii w JSW Group

| ITEM | 2021 | 2020 | GROWTH RATE 2020=100 |

|---|---|---|---|

| ELECTRIC ENERGY (MWh) | |||

| Production | 140 883,9 | 99 864,9 | 141,1 |

| Purchase | 994 125,3 | 988 387,2 | 100,6 |

| Own use | 1 125 585,3 | 1 079 875,8 | 104,2 |

| Sale | 9 418,2 | 8 376,4 | 112,4 |

| HEATING (STEAM, HOT WATER) (GJ) | |||

| Production | 26 424,0 | 16 613,0 | 159,1 |

| Purchase | 955 578,6 | 828 979,0 | 115,3 |

| Own use | 982 002,7 | 845 592,0 | 116,1 |

| Sale | - | - | - |

| COOLING (GJ) | |||

| Production | 218 210,0 | 222 221,0 | 98,2 |

| Purchase | 230 804,0 | 209 186,0 | 110,3 |

| Own use | 449 014,0 | 431 407,0 | 104,1 |

| Sale | - | - | - |

UE TAXONOMY

The Group is disclosing for the first time in this Statement information regarding the so-called EU Taxonomy which sets out the criteria for recognizing an activity as environmentally sustainable. This obligation follows from Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment ("Regulation 2020/852"), which requires disclosure of whether and to what extent an undertaking's economic activities comply with the assumptions of the EU Taxonomy.

An environmentally sustainable activity is, according to the EU Taxonomy, an activity that:

- contributes substantially to one or more of the environmental objectives,

- complies with technical screening criteria,

- does not significantly harm any of the environmental objectives, and

- complies with the minimum safeguards.

The EU Taxonomy creates a common tool for investors and undertakings to classify sustainable economic activities. Its purpose is to assist investors in making investment decisions and to define activities that can be considered sustainable.

According to the Commission Delegated Regulation (EU) 2021/21781, starting from 1 January 2022 until 31 December 2022, non-financial undertakings are to disclose the percentage share of their activities eligible or not eligible for the EU Taxonomy in their total:

- turnover (revenue),

- capital expenditures (“CapEx”),

- operating expenses (“OpEx”),

as well as related contextual (i.e. explanatory) information.

In addition, the regulation clarifies the reporting obligations indicated in Article 8 of the EU Taxonomy. It defines the content and methodology, and presents reporting templates for financial and non-financial undertakings.

For the purposes of the 2021 disclosures, the JSW Management Board has for the first time analyzed its activities for eligibility to the EU Taxonomy. The eligibility was assessed against the first two objectives for which lists of activities and their corresponding technical eligibility criteria were published (a Taxonomy-eligible activity means an economic activity described in at least one of the aforementioned annexes regardless of whether it meets any technical eligibility criteria):

- OBJECTIVE I - Climate change mitigation - Annex I of Commission Delegated Regulation (EU) 2021/21392 and

- OBJECTIVE I - Climate change adaptation - Annex I of Commission Delegated Regulation (EU) 2021/2139.

Eligibility and compliance with individual environmental objectives will be reported by undertakings in later periods.

The Group's core business activities are largely outside the scope of the activities currently defined for the first two environmental objectives. However, Regulation 2020/852 will evolve and the list of activities covered will expand.

In 2022, the EU is expected to publish technical eligibility criteria for the four remaining objectives:

- Sustainable use and protection of water and marine resources,

- Transition to a circular economy,

- Pollution prevention and control,

- Protection and restoration of biodiversity and ecosystems.

The Group has, for the first time, analyzed its 2021 activities in terms of the EU Taxonomy eligibility and hereby presents key performance indicators pertaining to the proportion of turnover (i.e. revenue), capital expenditures and operating expenses related to eligible activities.

The key performance indicators were prepared both on a consolidated level in relation to the JSW Group and on a separate level in relation to the Parent Company.

1 Commission Delegated Regulation (EU) 2021/2178 of 6 July 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation ("Delegated Act on Article 8 of the EU Taxonomy").

2 Commission Delegated Regulation (EU) 2021/2139 of 4 June 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining whether that economic activity causes no significant harm to any of the other environmental objectives ("Delegated Act establishing technical eligibility criteria").

ANALYSIS OF ELIGIBLE ACTIVITIES

In the process of preparing the 2021 disclosures, a detailed analysis of the activities was carried out at all Group companies. As a condition for an activity to be considered eligible, the actual activity was assumed to be consistent with the activity description in Annexes I or II of the Delegated Act establishing the technical eligibility criteria. Financial data for eligible activities includes both revenues (turnover) from conducted eligible economic activities, related capital expenditures (CapEx) and/or operating expenses (OpEx), and purchases made in 2021 from eligible activities. The definitions in Annex I of the Commission Delegated Regulation (EU) 2021/2178 were used to calculate the indicators, taking into account relevant consolidation eliminations.

CALCULATION RULES FOR EU TAXONOMY INDICATORS

The disclosures have been prepared taking into account the principle of avoiding double counting, i.e. the different activities have been allocated to only one eligible activity and each part of revenue, CapEx and OpEx has been included only once. If a particular revenue-generating activity in 2021 was assigned to any of the eligible activities, then the capital expenditures (CapEx) and operating expenses (OpEx) associated with that activity were also assigned to that activity, no longer subject to evaluation for eligibility to any of other eligible activities.

In contrast, the remaining CapEx and OpEx that could not be considered to be related to eligible revenue-generating activities were analyzed for their possible classification as purchases from eligible activities, subject to the principle that they could only be attributed to one, best matching activity.

The JSW Management Board adopted the rules for calculation of the indicators described in the annexes to the Delegated Act on Article 8 of the EU Taxonomy regarding the disclosures for calculating the eligible portion of turnover (revenues), capital expenditures and operating expenses.

TAXONOMY INDICATORS FOR THE PARENT COMPANY

In the first year of the new reporting requirements, the Parent Company discloses the percentage of turnover (revenue), capital expenditures, and operating expenses that are EU Taxonomy-eligible without having to verify the technical eligibility criteria, i.e. determining what percentage of these three values is consistent with the EU Taxonomy.

| 2021 | TOTAL | TAXONOMY-ELIGIBLE | TAXONOMY-NON-ELIGIBLE | ||

|---|---|---|---|---|---|

| PLN m | % | PLN m | % | PLN m | |

| Turnover (Revenue) | 13 550,4 | 0,3% | 34,4 | 99,7% | 13 516,0 |

| CapEx* | 1 357,7 | 2,5% | 34,5 | 97,5% | 1 323,2 |

| OpEx** | 408,0 | 6,8% | 27,8 | 93,2% | 380,2 |

* The total includes Objective I Climate change mitigation.

** Including the value of operating expenses related to climate change adaptation (Objective II): for activity 9.2 the value of PLN 7.8 million.

SHARE OF TURNOVER (REVENUE) RELATED TO ELIGIBLE ACTIVITIES IN TOTAL REVENUE

As JSW's operations are focused on the mining industry and mainly involve the production of coking coal, the 2021 turnover indicator includes mainly activities related to selective collection and transportation of waste, which are taxonomy-eligible according to Annex I to Delegated Regulation 2021/2139.

The indicator was calculated by dividing the total revenue from eligible activities presented in the Parent Company's EU Taxonomy-eligible activities table by sales revenue for 2021:

- The numerator of the indicator was revenue from eligible activities - the total turnover attributable to eligible activities relates to revenue from contracts with customers,

- The basis (denominator) for the turnover indicator was JSW’s 2021 sales revenue as disclosed in the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2021, in Note 3.1.

SHARE OF CAPITAL EXPENDITURES RELATED TO ELIGIBLE ACTIVITIES IN TOTAL CAPITAL EXPENDITURES

The values included in CapEx relate only to direct expenditures on property, plant and equipment, intangible assets, investment property and right-of-use assets. There were no increases related to the acquisition of subsidiaries in 2021. The capital expenditures shown for eligible activities relate to, among other things, projects to improve the energy efficiency of buildings, the purchase of machinery and equipment that will make it possible to reduce energy consumption in future years, which will directly contribute to lower greenhouse gas emissions through the use of low-carbon technologies.

JSW's capital expenditure indicator related to eligible activities was calculated by dividing:

- the total capital expenditures related to eligible activities presented in the Parent Company's activities eligible for the EU Taxonomy table,

- by the total capital expenditures recognized in the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2021, respectively:

- property, plant and equipment (including expensable mining pits) – Note 6.1.

- intangible assets – Note 6.2.

- related to right-of-use assets – Note 6.3.

- investment property – Note 6.5.

SHARE OF OPERATING EXPENSES RELATED TO ELIGIBLE ACTIVITIES IN TOTAL OPERATING EXPENSES

In accordance with the definition of the Delegated Act on Article 8 of the EU Taxonomy, the operating expenses included in the calculation of the indicator, include both in the numerator and in the denominator, the costs related to the day-to-day operation of property, plant and equipment, i.e. incurred for the purposes of carrying out repairs and maintenance of individual property, plant and equipment items. In accordance with the OpEx definition, non-capitalized costs related to research and development and non-capitalized short-term lease costs were also included.

The Company has not included expenses for energy, among other things, as they do not represent direct expenses related to the day-to-day operation of property, plant and equipment, as reported in the Draft Commission notice on the interpretation of certain legal provisions of the Disclosures Delegated Act under Article 8 of EU Taxonomy Regulation on the reporting of eligible economic activities and assets published on 2 February 2022.

DESCRIPTION OF JSW ACTIVITIES ELIGIBLE FOR THE EU TAXONOMY

Activities of the Parent Company that are eligible for the EU Taxonomy

| ACTIVITY NUMBER* | ECONOMIC ACTIVITIES UNDER DELEGATED COMMISSION REGULATION (EU) 2021/2139 | DESCRIPTION OF THE ACTIVITIES IN JSW |

|---|---|---|

| 3.6 |

Manufacture of other low carbon technologies |

Purchasing under economic activities (CapEx and OpEx). |

| 4.15 | District heating/cooling distribution | Purchasing under economic activities (OpEx). |

| 5.1 | Construction, extension and operation of water collection, treatment and supply systems | Revenue generated in these economic activities - turnover and related CapEx and OpEx are shown. |

| 5.3 | Construction, extension and operation of water collection, treatment and supply systems | Purchasing under economic activities (OpEx). |

| 5.5 | Collection and transport of non-hazardous waste in source segregated fractions | Revenue generated in these economic activities - turnover and related OpEx are shown. |

| 7.2 | Renovation of existing buildings | Purchasing under economic activities (OpEx). |

| 7.3 | Installation, maintenance and repair of energy efficiency equipment | Purchasing under economic activities (OpEx). |

| 8.1 | Data processing, hosting and related activities | Purchasing under economic activities (OpEx). |

| 9.2 | Close to market research, development and innovation | Purchasing under economic activities (OpEx). |

*The list of activities eligible for inclusion in the EU Taxonomy in the case of JSW was developed as a result of the analysis conducted with the participation of managers and industry specialists from individual business areas, controlling, ESG and external experts.

TAXONOMY INDICATORS FOR THE GROUP

In the first year of the new reporting requirements, the Group discloses the percentage of turnover (revenue), capital expenditures, and operating expenses that are EU Taxonomy-eligible without having to verify the technical eligibility criteria, i.e. determining what percentage of these three values is consistent with the EU Taxonomy.

| 2021 | SUMA | TAXONOMY-ELIGIBLE | TAXONOMY-NON-ELIGIBLE | ||

|---|---|---|---|---|---|

| PLN m | % | PLN m | % | PLN m | |

| Turnover (Revenue) | 10 629,1 | 1,1% | 114,0 | 98,9% | 10 515,1 |

| CapEx* | 1 668,4 | 3,1% | 51,9 | 96,9% | 1 616,5 |

| OpEx** | 563,4 | 8,6% | 48,2 | 91,4% | 515,2 |

* Including the value of capital expenditures related to climate change adaptation (Objective II): for activity 9.2 the value of PLN 2.1 million.

** Including the value of operating expenses related to climate change adaptation (Objective II): for activity 9.2 the value of PLN 13.5 million.

SHARE OF TURNOVER (REVENUE) RELATED TO ELIGIBLE ACTIVITIES IN TOTAL REVENUE

As the Group’s operations are focused on the mining industry and mainly involve the production of coking coal and coke, the 2021 turnover indicator includes mainly activities related to selective collection, transportation of waste ad rail infrastructure, which are taxonomy-eligible according to Annex I to Delegated Regulation 2021/2139.

The indicator was calculated by dividing the total revenue from eligible activities presented in the Group’s EU Taxonomy-eligible activities table by consolidated sales revenue for 2021:

- The numerator of the indicator was revenue from eligible activities - the total turnover attributable to eligible activities relates to revenue from contracts with customers,

- The basis (denominator) for the turnover indicator was the Group’s 2021 sales revenue as disclosed in the Consolidated Financial Statements of the JSW S.A.

SHARE OF CAPITAL EXPENDITURES RELATED TO ELIGIBLE ACTIVITIES IN TOTAL CAPITAL EXPENDITURES

The values included in CapEx relate only to direct expenditures on property, plant and equipment, intangible assets, investment property and right-of-use assets. There were no increases related to the acquisition of subsidiaries in 2021. The capital expenditures shown for eligible activities relate to, among other things, projects to improve the energy efficiency of buildings, the purchase of machinery and equipment that will make it possible to reduce energy consumption in future years, which will directly contribute to lower greenhouse gas emissions through the use of low-carbon technologies.

The Group’s capital expenditure indicator related to eligible activities was calculated by dividing:

- the total capital expenditures related to eligible activities presented in the Group’s activities eligible for the EU Taxonomy table,

- by the Group’s total capital expenditures described in the Consolidated Financial Statements of the JSW S.A. Group for the financial year ended 31 December 2021, respectively.

- property, plant and equipment (including expensable mining pits) – Note 7.1.

- intangible assets – Note 7.3.

- right-of-use assets – Note 7.4.

- investment property – Note 7.6.

SHARE OF OPERATING EXPENSES RELATED TO ELIGIBLE ACTIVITIES IN TOTAL OPERATING EXPENSES

In accordance with the definition of the Delegated Act on Article 8 of the EU Taxonomy, the operating expenses included in the calculation of the indicator, include both in the numerator and in the denominator, the costs related to the day-to-day operation of property, plant and equipment, i.e. incurred for the purposes of carrying out repairs and maintenance of individual property, plant and equipment items. In accordance with the OpEx definition, non-capitalized costs related to research and development and non-capitalized short-term lease costs were also included.

The Group has not included expenses for energy, among other things, as they do not represent direct expenses related to the day-to-day operation of property, plant and equipment, as reported in the Draft Commission notice on the interpretation of certain legal provisions of the Disclosures Delegated Act under Article 8 of EU Taxonomy Regulation on the reporting of eligible economic activities and assets published on 2 February 2022.

DESCRIPTION OF THE GROUP’S ACTIVITIES ELIGIBLE FOR THE EU TAXONOMY

Group's activities eligible for the EU Taxonomy

| ACTIVITY NUMBER* | ECONOMIC ACTIVITIES UNDER DELEGATED COMMISSION REGULATION (EU) 2021/2139 | CHARACTERISTICS OF THE ACTIVITIES WITHIN THE JSW GROUP |

|---|---|---|

| 3.6 |

Manufacture of other low carbon technologies |

Purchasing under economic activities (CapEx and OpEx). |

| 3.14 | Manufacture of organic basic chemicals | Revenue generated in these economic activities - related CapEx and OpEx are shown. |

| 4.1 | Electricity generation using solar photovoltaic technology | Revenue generated in these economic activities - turnover and related CapEx, as well as purchases under the activities (CapEx) are shown. |

| 4.15 | District heating/cooling distribution | Purchasing under economic activities (OpEx). |

| 4.16 | Installation and operation of electric heat pumps | Purchasing under economic activities (CapEx). |

| 5.1 | Construction, extension and operation of water collection, treatment and supply systems | Revenue generated in these economic activities - turnover and related CapEx and OpEx are shown. |

| 5.3 | Construction, extension and operation of water collection, treatment and supply systems | Revenue generated in these economic activities - turnover and related CapEx and OpEx, as well as purchases under the activities (OpEx) are shown. |

| 5.5 | Collection and transport of non-hazardous waste in source segregated fractions | Revenue generated in these economic activities - turnover and related OpEx are shown. |

| 6.2 | Freight rail transport | Revenue generated in these economic activities - turnover and related CapEx and OpEx are shown. |

| 6.6 | Freight transport services by road | Revenue generated in these economic activities - turnover and related CapEx and OpEx are shown. |

| 6.14 | Infrastructure for rail transport | Revenue generated in these economic activities - turnover and related CapEx and OpEx are shown. |

| 7.2 | Renovation of existing buildings | Purchasing under economic activities (OpEx). |

| 7.3 | Installation, maintenance and repair of energy efficiency equipment | Purchasing under economic activities (OpEx). |

| 8.1 | Data processing, hosting and related activities | Purchasing under economic activities (OpEx). |

| 9.2 | Aid designated for market research, development and innovation | Revenue generated in these economic activities was shown with the related CapEx and OpEx, as well as purchases for these activities (OpEx). |

* The list of activities eligible for inclusion in the EU Taxonomy in the case of the Group was developed as a result of the analysis conducted with the participation of managers and industry specialists from individual business areas, controlling, ESG and external experts.