Corporate governance and corporate governance rules

Addressing the expectations of our stakeholders, we care for effective and transparent management. It is important for us to maintain the balance between the interests of all entities involved in the operations of JSW and the Group in a manner ensuring development and creation of value. The Group observes the highest standards and best practices of transparency and corporate governance. It is aware of the need to implement solutions related to ethics management and responsibility in the supply chain. Implementation of solutions of this type boosts the Group’s credibility among business partners and in the investor community and makes the Group more stable and predictable in terms of management of business risk.

KEY GROUP MANAGEMENT PRINCIPLES AND THEIR CHANGES

The powers of the corporate bodies of the each Group company follow from the provisions of the Commercial Company Code (“CCC”) and the articles of association/incorporation deeds of the respective company.

The Group’s functioning and organization is regulated by the JSW Group Code. The provisions of this Code place emphasis on all of the companies cooperating and pursuing the interests of the Group, they make it possible for the JSW Management Board to implement uniform procedures and standards of conduct and control over internal processes in the Group. As of 31 December 2022, the Group had 37 common procedures, policies and bylaws in place, ensuring consistency and transparency of company operations, and reducing business and legal risks within the Group.

One of these procedures is embodied by the Corporate Governance Principles in the JSW Group, regulating ownership supervision in governing the Group. The Corporate Governance Principles are supposed to enhance the effectiveness of the Group’s management and the functioning of its constituent entities and implementing corporate governance forms and procedures of ownership supervision that go beyond what is required by the binding provisions of law.

The Group has in place a Compensation Policy for Corporate Bodies of JSW’s Subsidiaries, which describes the basic principles shaping the compensation of the persons covered by the Compensation Policy, the procedure governing the compensation of the corporate bodies of JSW's direct and indirect subsidiaries, sets the framework within which the compensation of persons serving on these bodies should fall, and obliges the management boards of companies that have their own subsidiaries to apply the Compensation Policy. In addition, it introduces an obligation for the management boards of subsidiaries to provide selected information, and defines in detail the manner in which resolutions are adopted to account for the achievement of management objectives.

In addition, the Parent Company has in place a JSW Management Compensation Policy, which contains internal regulations on the rules for compensating JSW's key executives. It also defines the compensation framework for the various jobs covered by this policy and defines in detail the contracting rules for these employees.

In addition, the powers of the corporate bodies of the given Group company follow from the provisions of the Commercial Company Code (“CCC”) and the articles of association/incorporation deeds of the respective company.

BASIC MANAGEMENT PRINCIPLES IN THE PARENT COMPANY AND THEIR CHANGES

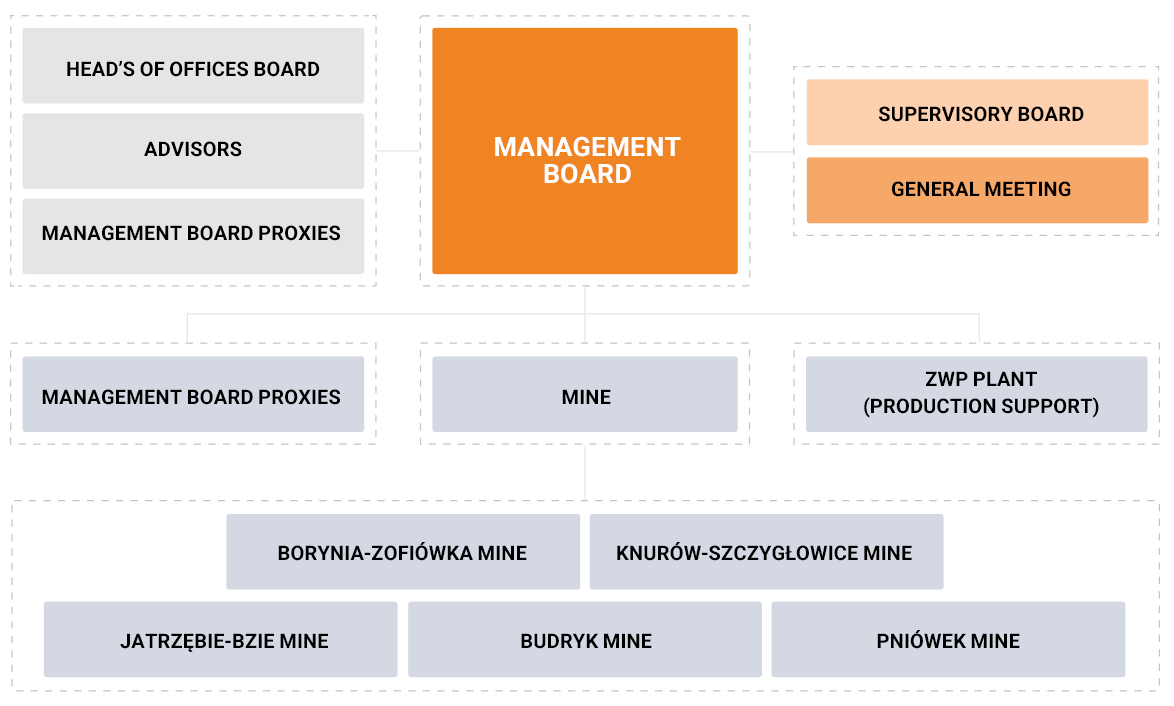

As at the date of this report, JSW’s enterprise consisted of five hard coal mines in which coking coal and steam coal are mined, as well as the Production Support Unit and the Management Board Office. The internal organization of the Company’s Plants is defined in separate Organizational Bylaws and Organizational Charts.

In accordance with the JSW Articles of Association, the Parent Company’s governing bodies are: the Management Board, the Supervisory Board and the Shareholder Meeting. The powers of JSW’s governing bodies stem from the provisions of the Commercial Company Code and the Articles of Association of JSW. The powers of the Company’s individual governing bodies are defined in:

Management Board – Management Board Bylaws,

Supervisory Board – Supervisory Board Bylaws,

Shareholder Meeting – Shareholder Meeting Bylaws.

The composition and matters within the powers of the Management Board and the Supervisory Board are described in detail here.

The manner of proceeding of the Shareholder Meeting and its powers are presented here.

JSW’s organizational chart as at 31 December 2022*

* After the end of the reporting period, i.e. on 1 January 2023, KWK Jastrzębie-Bzie was incorporated into the structure of KWK Borynia-Zofiówka as the Bzie Section and, consequently, KWK Borynia-Zofiówka became a three-section mine under the name KWK Borynia-Zofiówka-Bzie.

Changes to the Company’s governance rules in 2022

To streamline the Company’s governance, in 2022 the Management Board adopted a number of resolutions pertaining to changes in the organizational structure of the Company’s Management Board Office and its mines. These changes intended to enhance the effectiveness of governance and adapt to the evolving market environment.

The key changes in the Company’s governance in 2022 pertained to the following:

- changing the organizational structure of the Management Board Office, concerning, among other things, strengthening the supervision over the operation of subsidiaries, optimizing the organizational structure in the areas of communication and promotion, compliance, shipping, strategy, fundraising, innovation and diversification of operations, as well as adjusting the organizational structure to the implementation of tasks envisaged in the JSW Group's environmental strategy and challenges arising from the energy market,

- updating the Mines’ Framework Organizational Charts to improve management efficiency and adapt to evolving market and legal conditions,

- changing the organizational structure of the two mines involving the subordination, as of 1 January 2023, of KWK Jastrzębie-Bzie as the Bzie Section to KWK Borynia-Zofiówka and changing the name of KWK Borynia-Zofiówka to KWK Borynia-Zofiówka-Bzie.

CORPORATE GOVERNANCE STATEMENT

Pursuant to § 70 section 6 item 5) and § 71 sections 4 and 5 of the Finance Minister’s Regulation of 29 March 2018 on the Current and Periodic Information Transmitted by Securities Issuers and the Conditions for Recognizing the Information Required by the Regulations of a Non-Member State as Equivalent, JSW S.A. Management Board hereby presents its Corporate Governance Statement in 2022.

Identification of corporate governance rules being applied

By Resolution no. 26/1413/2015 of the Warsaw Stock Exchange Supervisory Board on 13 October 2015. On 29 March 2021 the Supervisory Board of the Warsaw Stock Exchange by Resolution no. 13/1834/2021 ratified the new principles of corporate governance for companies listed on WSE’s Main Market – Code of Best Practice for WSE Listed Companies 2021 (“DPSN 2021”), which entered into force on 1 July 2021. In accordance with the time limit specified by the WSE, JSW on 30 July 2021 provided to the public Information on the status of the company’s observance of rules included in the Code of Best Practice for WSE Listed Companies 2021.

The text of the Code of Best Practice 2021 is published on the website of the WSE at the following address: https://www.gpw.pl/dobre-praktyki2021

IDENTIFICATION OF THE SET OF CORPORATE GOVERNANCE RULES ON THE APPLICATION OF WHICH JSW COULD DECIDE VOLUNTARILY

JSW does not apply any corporate governance rules going beyond the requirements prescribed by the documents entitled “Code of Best Practice for WSE Listed Companies 2021”.

IDENTIFICATION OF ANY INFORMATION ABOUT THE CORPORATE GOVERNANCE PRACTICES GOING BEYOND THE REQUIREMENTS PROVIDED FOR BY THE NATIONAL LAW APPLIED BY JSW

JSW does not apply any corporate governance rules going beyond the requirements prescribed by the documents entitled “Code of Best Practice for WSE Listed Companies 2021”.

IDENTIFICATION OF CORPORATE GOVERNANCE RULES NOT APPLIED

JSW aims to apply corporate governance rules as described in the DPSN 2021 collection as widely as possible and reviews on an ongoing basis how and to what extent they are complied with. In 2022, in accordance with § 29 section 3 of the Stock Exchange Regulations, JSW provided to the public two current reports via the Electronic Information Base (“EIB”), including updated Information on the status of the Company’s observance of rules included in the Code of Best Practice for WSE Listed Companies 2021, extending its scope of application by additing two new rules:

- Rule 1.4.1.To ensure quality communications with stakeholders, as a part of the business strategy, companies publish on their website information concerning the framework of the strategy, measurable goals, including in particular long-term goals, planned activities and their status, defined by ratios, both financial and non-financial. ESG information concerning the strategy should among others: explain how the decision-making processes of the company and its group members integrate climate change, including the resulting risks – in H1 2022, the JSW Management Board and the Supervisory Board approved The JSW Strategy, including JSW Group’s subsidiaries, for 2022-2030, setting new directions for the actions and projects to support the Group’s efforts to grow the value of JSW and the overall Group. Strategic objectives have been defined and parameterized in accordance with the current and forecast market standing of the company. To ensure appropriate communications with stakeholders about the adopted business strategy, the Company published on its website information concerning the assumptions of the strategy, measurable goals, including in particular long-term goals, planned activities and their status, defined by ratios, both financial and non-financial. Information about the ESG strategy explain how the decision-making processes of JSW and its Group members consider climate change issues, including the resulting risks. The relevant information is available at JSW’s website at: https://www.jsw.pl/relacje-inwestorskie/strategia,

- Rule 2.9. The supervisory board chairperson should not combine this function with that of managing the supervisory board audit committee. – as of July 2022, the functions of the Chairperson of the Supervisory Board and the Chairperson of the Audit Committee operating within the Supervisory Board have been separated.

The Parent Company applies 58 out of 63 rules defined in the Code of Best Practice for WSE Listed Companies 2021 (5 rules are not applied). Therefore, the COMPLY DPSN 2021 JSW ratio is 92% The Company’s COMPLY ratios with regard to each of the chapters of DPSN 2021 are as follows:

- Disclosure Policy and Communications – 90%

- Management Board and Supervisory Board – 81%

- Internal Systems and Functions – 100%

- Shareholder Meeting and Investor Relations – 93%

- Conflict of Interest and Transactions with Related Parties – 100%

- Payroll – 100%

According to the content of the most recent current report of 22 July 2022, and as at the date of publication of this report, JSW has not applied the following DPSN 2021 Rules

Information policy and communication with investors

Rule 1.4.2

Policy content

To ensure quality communications with stakeholders, as a part of the business strategy, companies publish on their website information concerning the framework of the strategy, measurable goals, including in particular long-term goals, planned activities and their status, defined by ratios, both financial and non-financial. Information on the ESG strategy should, among others: present the equal pay index for employees, defined as the percentage difference between the average monthly pay (including bonuses, awards and other benefits) of women and men in the last year, as well as present information about actions taken to eliminate any pay gaps, including a presentation of related risks and the time horizon of the equality target.

Company’s commentary:

The principle of proportionality and comparability of remuneration in the case of JSW is difficult to apply due to the specificity of the production process operating in the mining industry, which because of its nature is mainly based on work and remuneration of men

Management Board and Supervisory Board

Rule 2.1.

Policy content:

Companies should have in place a diversity policy applicable to the management board and the supervisory board, approved by the supervisory board and the shareholder meeting, respectively. The diversity policy defines diversity goals and criteria, among others including gender, education, expertise, age, professional experience, and specifies the target dates and the monitoring systems for such goals. With regard to gender diversity of corporate bodies, the participation of the minority group in each body should be at least 30%.

Company’s commentary:

As at the date of publication of this report JSW does not have in place a diversity policy applicable to the Management Board and Supervisory Board which would specify the diversity goals and criteria according to this rule. According to JSW, the failure to adopt such policies does not affect the assurance of the highest standards in the performance and effective discharge of the duties of the Management Board and the Supervisory Board. Due to the fact that JSW is a company with the State Treasury shareholding, the persons who are to perform functions at the company bodies are elected according to the criteria provided for in the provisions of the Act of 16 December 2016 on the Rules for Managing State Property. The criteria adopted in the act aim to ensure that persons performing functions in management and supervisory positions in a company with the State Treasury shareholding have the level of education, professional experience and competences adequate for the performance of these functions.

Rule 2.2.

Policy content:

Decisions to elect members of the management board or the supervisory board of companies should ensure that the composition of those bodies is diverse by appointing persons ensuring diversity, among others in order to achieve the target minimum participation of the minority group of at least 30% according to the goals of the established diversity policy referred to in principle 2.1.

Company’s commentary:

The Members of the Management Board and Supervisory Board of JSW are elected observing the principle of equal access of women and men to the position at statutory bodies of the company. At the date of publication of this report, the JSW shall be gender differentiated at the level specified in this rule for the Supervisory Board. This ratio is not met for the JSW Management Board. In connection with there being no policies referred to in Rule 2.1, the rule is not applied.

Rule 2.11.6.

Policy content:

In addition to its responsibilities laid down in the legislation, the supervisory board prepares and presents an annual report to the Ordinary Shareholder Meeting once per year. The above report includes at least information regarding the degree of implementation of the diversity policy applicable to the Management Board and the Supervisory Board, including the achievement of goals referred to in Rule 2.1.

Company’s commentary:

As at the date of publication of this report, JSW does not have in place a diversity policy applicable to the Management Board and Supervisory Board which would specify the diversity goals and criteria, therefore, a failure to apply this rule results from a failure to apply Rules 2.1. and 2.2.

Shareholder meeting and investor relations

Rule 4.1.

Policy content:

Companies should enable their shareholders to participate in a shareholder meeting by means of electronic communication (e-meeting) if justified by the expectations of shareholders notified to the company, provided that the company is in a position to provide the technical infrastructure necessary for such general meeting to proceed.

Company’s commentary:

JSW is refraining from using that rule because of legal as well as organizational and technical risks which may threaten the correct course of the Shareholder Meeting if shareholders are provided with a possibility of participating in the meeting via remote channels.

Primary attributes of internal control and risk management systems in reference to the preparation of financial statements and consolidated financial statements.

For the purpose of procuring that the financial statements are true and fair and comply with the binding regulations of law and of generating high quality financial data, the Group has in place internal control and risk management systems. The Parent Company’s Management Board is responsible for the internal control system and its effectiveness in the process of preparing the financial statements and the periodic reports prepared and published in accordance with the principles of the Regulation.

CONTROL, RISK MANAGEMENT AND COMPLIANCE SYSTEM

In order to ensure the accuracy and reliability of financial reporting, as well as compliance with legal regulations, the Group applies the following principles:

- the implementation of the Documentation of adopted accounting principles (policies) in accordance with IFRS, in force at JSW and its subsidiaries, and its ongoing updating on the basis of changes in the law or new regulations,

- the verification of the applicable accounting policies by the Group companies,

- the application of procedures for recording economic events in the financial and accounting system and checking their compliance,

- the continuous application of the cohesive IFRS-compliant accounting rules with regard to measurement, recognition and disclosures of financial data in the financial statements, periodic reports and other reports conveyed to shareholders,

- the use of internal controls, including: division of responsibilities, multi-stage data authorization, independent checks,

- providing subsidiaries with standardized report templates and guidelines for their preparation, including work schedules,

- verification of the correctness of the accounting rules and disclosures included in the companies’ reports.

- verification of the financial statements of the Group companies against the data entered into the integrated IT HFM system, used to prepare the consolidated financial statements of the Group,

- reviews and audits by a statutory auditor of published financial statements,

- independent and objective assessment of risk management and internal control systems through inspections carried out by internal audit.

The data disclosed in the financial statements come from JSW’s accounting records and additional information transmitted by JSW’s various organizational cells. However, to prepare consolidated financial statements, the Group companies transfer the required data in the form of reporting packages based on internal guidelines regulating detailed issues connected with principles, scope and deadlines for preparing the packages.

The preparation of financial statements is supervised by the Vice-President of the Management Board for Financial Matters. The Chief Accountant of JSW is responsible for preparing the standalone and consolidated financial statements, and the Management Boards of the consolidated companies are responsible for preparing the reporting packages for the Group’s consolidated financial statements.

IT SOLUTIONS

The data from the accounting ledgers ensure the accuracy of the financial statements as they contain evidence entered on the basis of the appropriate source documentation, while using the most modern IT technology. The system’s modular structure provides for a transparent split of areas and competencies, the coherence of the records of operations in the accounting ledgers and control between the ledgers. The finance and accounting system includes instructions and control mechanisms to ensure data consistency and integrity. In the process of preparing consolidated financial statements, Group companies use the same consolidation system for collecting and processing data from subsidiaries. Consolidated financial statements are prepared using specialized IT tools, which makes it possible to streamline the financial consolidation process and shorten the time needed to prepare consolidated financial statements by, among other things, an extensive mechanism for automatically validating the consistency of financial data entered by the companies.

The safe operation of the IT system is ensured by an appropriate structure of entitlements, which are granted to authorized employees only within the scope of their duties. These entitlements are subject to ongoing review. Control of access is exercised at every stage of preparing the financial statements, starting from entering source data, through data processing to generating output information.

AUDIT COMMITTEE

The body that oversees the financial reporting process at JSW is the Supervisory Board Audit Committee. The main purpose of the Audit Committee is to support the Supervisory Board in exercising financial supervision and to provide the Supervisory Board with reliable information and opinions that allow it to efficiently make correct decisions in the area of financial reporting, internal control and risk management.

Monitoring of the financial reporting process and evaluation of the financial statements by the Supervisory Board is the final stage of verification and control, ensuring the accuracy and reliability of the information presented in the JSW Group's standalone and consolidated financial statements. Proper management of the process of recording and preparing financial statements ensures the achievement of security and a high level of information.

INTERNAL CONTROL SYSTEM

The internal control system in operation in JSW covers all of its operations contemplated in the Articles of Association and all the levels of organizational structure, and thereby all the processes in JSW, including the areas of internal control, compliance, internal audit and risk management, as well as those having a direct or indirect impact on the correctness of preparing the financial statements. Within this system, JSW has a number of implemented control mechanisms and internal regulations which relate to the functioning of the areas of internal control, compliance, internal audit and risk management.

One of the components of the evaluation of the internal control system is the audit and inspection activities performed by the Audit and Control Department. As a result of completed audit and control tasks, recommendations and post-audit instructions are issued to improve control mechanisms and minimize risks. The Audit and Control Department conducts monitoring of the implementation of the recommendations and instructions.

The effectiveness of the risk management system is ensured by: reviews of risks in terms of their adequacy and adjustment to the structure and uniqueness of Group's operations, taking into account external and internal factors; reviews and assessments of risks carried out by individual Risk Owners; internal audits conducted as part of independent control of risk management along with a proposal to improve the system; regular reporting of the results of changes in the assessment of risks addressed to the Management Board, the Audit Committee, the JSW Supervisory Board and information about the Company provided to the Ministry of State Assets.

Description of the rules for amending the Company's Articles of Association

The Articles of Association are amended by way of a resolution adopted by the Shareholder Meeting where a subsequent decision of a relevant court must be issued to enter the amendment in the National Court Register (KRS). An amendment to the Articles of Association materially changing the Company’s line of business (Article 416 § 1 of the Commercial Company Code) shall not require a buyout of the shares held by shareholders objecting to such an amendment if the relevant resolution of the Shareholder Meeting is adopted by a majority of two thirds of the votes in the presence of shareholders representing at least one half of the share capital. Once the amendments to the Articles of Association are entered in the KRS, JSW immediately publishes a current report informing the public of the entry. In 2022, no amendments were made to the JSW’s Articles of Association.

Management Board

Powers of the JSW Management Board

The Management Board handles the Company’s matters and represents it in and out of court of law, sets its strategic directions and determines its targets and objectives as well as makes decisions in all matters not restricted for other Company’s corporate bodies. The Management Board is also obligated to cooperate with the trade union organizations operating in the Company’s business.

The President of the Management Board supervises the overall operation of the Company, manages the work of the Management Board and names the Vice-President to perform these duties in his or her absence. The President of the Management Board convenes the Management Board meetings and chairs them and takes decisions which are not reserved to the powers of the Company’s governing bodies. If no substitute is named for the period of absence of the President of the Management Board, then the substitute is the Vice-President of the Management Board for Technical and Operational Matters. The scope of responsibilities of the President of the Management Board includes the exercise of direct supervision over the work of reporting organizational units/employees. The Vice Presidents oversee the overall activity of the Company and take decisions not reserved to the powers of the Company’s governing bodies, and in particular they oversee the operation of the organizational units/employees.

MATTERS REQUIRING RESOLUTIONS BY THE MANAGEMENT BOARD:

- determining the organizational bylaws defining the Company's organization,

- appointing general proxies,

- buying and selling real property,

- matters in which the Management Board addresses the Shareholder Meeting and the Supervisory Board,

- issuing promissory notes,

- determining the bylaws governing the operation of the internal control system.

The Management Board may grant Powers of Attorney to manage the Company’s matters related to the operations of the relevant Plant/Office and specific Powers of Attorney to natural persons.

Two Management Board Members acting jointly or a Management Board member acting with a commercial proxy are authorized to make declarations of will and affix signatures on behalf of the Company.

RULES OF PROCEDURE OF THE MANAGEMENT BOARD

The Management Board operates on the basis of the CCC, JSW’s Articles of Association, the Management Board Bylaws, the JSW Organizational Bylaws, internal regulations and other provisions of the law. The Management Board Bylaws are adopted by the Management Board and approved by a Supervisory Board resolution. They define the core duties of the Management Board, the composition of the Management Board and powers of the Management Board Members, describe issues related to handling the Company’s matters, providing information and rules for organizing Management Board meetings as well as issues related to non-competition of Management Board Members and conflict of interest. The Management Board handles the Company’s matters and represents it, sets its strategic directions and determines its targets and objectives as well as makes decisions in all matters not restricted for the Company’s other corporate bodies.

Management Board Members perform their responsibilities in accordance with the function specified by the Supervisory Board in the resolution on appointment to the Management Board. They supervise the Company’s overall operations and exercise direct supervision over the work of reporting organizational units belonging to the Division of the given Management Board Member, in accordance with the binding organizational chart of the Management Board Office available on the Company’s website. The Management Board oversees the work of each of the Company’s plants through the Plant Directors, the Management Board Office and the Management Board Representatives. Two Management Board Members acting jointly or one Management Board Member acting with a commercial proxy are authorized to make declarations of will and affix signatures on behalf of JSW. The Management Board grants Powers of Attorney to manage the Company’s matters related to the operations of the relevant Plant/Office and specific Powers of Attorney to natural persons. Fulfilling their duties, Management Board Members are guided by principles found in DPSN 2021.

Meetings of the Management Board are held at the Company’s head office. In justified cases, they may be held outside the head office. The President of the Management Board convenes Management Board meetings on their own initiative or upon request of one of the Management Board members at any time, also upon request of the Supervisory Board Chairperson. During the absence of the President of the Management Board, meetings are convened by the Management Board Member named by the President and if such a Member is not named, then the meetings are convened by the Vice-President of the Management Board for Technical and Operational Matters.

The Management Board may adopt resolutions if all Management Board Members have been duly notified of the Management Board meeting, i.e. each of the Management Board Members has been notified of the date and place of the meeting and the agenda at least one day before the meeting date and by the same day has received planned topics to be discussed and draft resolutions and decisions. In urgent matters, the Management Board may adopt resolutions without observing the procedure specified in the Management Board Bylaws.

Management Board Members may participate in a meeting personally and/or via means of direct remote communication, including means of electronic communication, in line with the Management Board Bylaws.

The Management Board may review motions and/or adopt resolutions at meetings (when all its members participating in the meeting are present at the place of the meeting or when all or some of its members participate in the meeting using means of direct remote communication) and outside of meetings (by following a written procedure or via means of direct remote communication using telecommunication devices or any other means that allow for identification of a Management Board Member).

The Management Board is also permitted to vote, review motions and adopt resolutions according to the following procedures:

- written ballot, consisting in written casting of the vote by each Management Board Member, including through another Management Board Member, by affixing signature under the draft motion / resolution, specifying a vote “for” the decision, “against” the decision or stating “abstaining” from voting. If this is not specified, the vote shall be deemed not cast,

- via means of direct remote communication (e.g. using electronic mail, teleconference, videoconference or dedicated IT system).

The Management Board reviews motions and adopts resolutions via means of direct remote communication in such a way that each of the Management Board Members participating in the ballot casts his or her vote sending a message by electronic mail / telephone/teleconference/videoconference or via a dedicated IT system, specifying whether he or she votes “for” the decision, “against” the decision or “abstains” from voting. If this is not specified, the vote shall be deemed not cast,

The decision on ordering a ballot following the procedures specified above is made by the President of the Management Board and, in his or her absence, by the Management Board Member convening the meeting, specifying at the same time the deadline for casting the votes. The date of review of a motion/adoption of a resolution following the above procedures is deemed to be the date of casting the last vote by a Management Board Member. If a Management Board Member does not take a stance by the set deadline, he or she shall be deemed not participating in the ballot.

Motions to the Management Board and draft resolutions to be adopted following the procedures specified above are delivered to all Management Board Members in hardcopy and/or via means of direct remote communication, while specifying the deadline for casting votes.

Management Board meetings are minuted. The Management Board votes in an open ballot, and its resolutions are adopted by an absolute majority of votes, where at least three Management Board Members attend the meeting. In the event of a tie vote, the President of the Management Board shall have the casting vote (except for voting on appointment of a commercial proxy, where unanimity of the Management Board Members is required). Whenever an “against” vote is cast and/or a dissenting opinion is submitted for the minutes by a Management Board Member, the minutes are immediately handed over to the Supervisory Board.

The Management Board Bylaws also allow the Management Board Members to sign documents with a qualified signature and provide for the possibility to vote using a dedicated IT system and define the basic duties of the Management Board.

RULES FOR APPOINTING AND DISMISSING MANAGEMENT BOARD MEMBERS

The Management Board consists of three to seven Members who are appointed for a joint 3-year term of office. The mandate of a Management Board member appointed before the end of the term of office of the Management Board expires simultaneously with the expiry of the mandates of the remaining Management Board members. In accordance with the amended Commercial Company Code, a term of office is counted in full financial years. Management Board Members are appointed and dismissed by the Supervisory Board following a qualification procedure (except for the Management Board Member appointed by JSW employees).

Powers of and requirements for Management Board Members follow, among others, from the Commercial Company Code, the Act on the Rules for Managing State Property, the Articles of Association and from announcement about recruitment procedures accepted by the Supervisory Board, and with reference to a Management Board Member elected by employees – from the Bylaws for electing and dismissing JSW S.A. Management Board Members by employees adopted by the Supervisory Board. A person appointed Vice-President of the Management Board for Technical and Operational Matters must additionally have qualifications for Head of Mine Operations at a mine extracting hard coal.

The Supervisory Board conducts a recruitment procedure in the event of occurrence of circumstances justifying appointment of a Management Board member. By initiating a recruitment procedure for the position of a Management Board Member, the Supervisory Board defines, by way of a resolution, the detailed rules and the method followed during the procedure, including in particular: the position subject to the procedure, the date and place where recruitment submissions are received, the date and place where interviews are held, the range of subjects discussed during the interview, the requirements and the method of evaluating the candidate. An announcement about a recruitment procedure is published on the Company’s website and in the Public Information Bulletin of the authority providing services to the competent Minister exercising the rights attached to the State Treasury’s shares, i.e. the Ministry of State Assets. The Supervisory Board shall inform the shareholders about the outcome of the recruitment procedure at the nearest Shareholder Meeting and make the recruitment procedure report available to them.

| A CANDIDATE FOR THE POSITION OF THE JSW’S MANAGEMENT BOARD MEMBER MUST FULFILL ALL OF THE FOLLOWING CONDITIONS: | THE FOLLOWING PERSON CANNOT BE A CANDIDATE FOR A MEMBER OF THE JSW’S MANAGEMENT BOARD: |

|---|---|

|

|

A Management Board Member submits his/her resignation to another Management Board Member or a commercial proxy with a copy to the Supervisory Board and the State Treasury – represented by the competent Minister exercising the rights attached to the State Treasury’s shares as long as the State Treasury remains a shareholder of the Company.

Management Board Member selected by JSW employees

If the average annual headcount in the Company exceeds 500 employees one Management Board member shall be elected by the Company employees, in accordance with the election bylaws adopted by the Supervisory Board. Results of the election are binding for the body authorized to appoint the Management Board, i.e. the Supervisory Board. No election of the employees’ representative to the Management Board of the Company does not constitute an obstacle for the Management Board to issue valid resolutions. Upon request of at least 15% of all the Company employees, a ballot shall be held to dismiss the Management Board member elected by employees. Such dismissal, death or other important reasons that decrease the number of Management Board Members by the Member elected by the Company’s employees shall require supplementary election. The Supervisory Board shall call supplementary elections within three weeks after it obtains information about the occurrence of a circumstance justifying the holding of supplementary elections. The supplementary election should be held within one month after it is called by the Supervisory Board.

The Supervisory Board shall call an election of the Management Board member to be elected by the employees for the next term within two months from the elapse of the last full year of the Management Board’s term of office. Such election should be held within two months after they are called by the Supervisory Board.

The election referred to above shall be held in a secret ballot as a direct and universal election by the Election Commission appointed by Supervisory Board from among Company employees. The Commission may not comprise a candidate to become a Management Board Member or a previous Management Board Member elected by employees.

Composition of the JSW Management Board

Table. COMPOSITION OF THE JSW MANAGEMENT BOARD

| FIRST AND LAST NAME | POSITION | TERM IN POSITION |

|---|---|---|

| COMPOSITION OF THE JSW MANAGEMENT BOARD OF THE 10TH TERM OF OFFICE | ||

| Tomasz Cudny | President of the Management Board | 01.01.2022 - 01.07.2022 |

| President of the Management Board entrusted with serving in the capacity of the Vice-President of the Management Board for Development | 01.01.2022 - 01.07.2022 | |

| Sebastian Bartos | Vice-President of the Management Board for Sales | 01.01.2022 - 01.07.2022 |

| Robert Ostrowski |

Vice-President of the Management Board for Financial Matters |

01.01.2022 - 01.07.2022 |

| Edward Paździorko |

Vice-President of the Management Board for Technical and Operational Matters |

01.01.2022 - 01.07.2022 |

| Artur Wojtków |

Vice-President of the Management Board for Employment and Social Policy (elected by employees) |

01.01.2022 - 01.07.2022 |

| COMPOSITION OF THE JSW MANAGEMENT BOARD OF THE 11TH TERM OF OFFICE | ||

| Tomasz Cudny | President of the Management Board | 01.07.2022 - 31.12.2022 |

| President of the Management Board entrusted with serving in the capacity of the Vice-President of the Management Board for Development | 01.07.2022 - 14.12.2022 | |

| Sebastian Bartos | Vice-President of the Management Board for Sales | 01.07.2022 - 31.12.2022 |

| Wojciech Kałuża | Vice-President of the Management Board for Development | 15.12.2022 - 31.12.2022 |

| Robert Ostrowski | Vice-President of the Management Board for Financial Matters | 01.07.2022 - 31.12.2022 |

| Edward Paździorko | Vice-President of the Management Board for Technical and Operational Matters | 01.07.2022 - 31.12.2022 |

| Artur Wojtków | Vice-President of the Management Board for Employment and Social Policy (elected by the employees) | 01.07.2022 - 31.12.2022 |

CHANGES TO THE JSW MANAGEMENT BOARD IN 2022

- On 10 May 2022, as a result of completed recruitment proceedings, the JSW Supervisory Board adopted resolutions to appoint the following persons to the JSW Management Board in the 11th term of office as of the date of holding the JSW Ordinary Shareholder Meeting approving the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2021 and the Management Board report on the activity of Jastrzębska Spółka Węglowa S.A. and the Jastrzębska Spółka Węglowa S.A. Group in the financial year ended 31 December 2021 e. as of 1 July 2022:

- Tomasza Cudnego as the President of the Management Board,

- Sebastiana Bartosa as the Vice-President of the Management Board for Sales,

- Roberta Ostrowskiego as the Vice-President of the Management Board for Financial Matters,

- Edwarda Paździorko as the Vice-President of the Management Board for Technical and Operational Matters.

- On 10 May 2022, as a result of the elections carried out by JSW employees to select a Member of the JSW Management Board in the 11th term of office, the JSW Supervisory Board adopted a resolution to appoint Mr. Artur Wojtków to the position of Vice-President of the Management Board for Employment and Social Policy as of the date of holding the JSW Ordinary Shareholder Meeting approving the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2021 and the Management Board report on the activity of Jastrzębska Spółka Węglowa S.A. and the Jastrzębska Spółka Węglowa S.A. Group in the financial year ended 31 December 2021 e. as of 1 July 2022.

- On 31 May 2022, the JSW Supervisory Board entrusted Mr. Tomasz Cudny with the duties of Vice-President of the Management Board for Development from the date of commencement of the new 11th term of office of the JSW Management Board, i.e. from 1 July 2022, to the date of appointment of the Vice-President of the Management Board for Development.

- On 14 December 2022, the JSW Supervisory Board adopted a resolution to appoint Mr. Wojciech Kałuża as of 15 December 2022 to the position of Vice-President of the Management Board for Development for the 11th term of office.

Table. COMPOSITION OF THE JSW MANAGEMENT BOARD ON THE DATE OF PREPARATION AND PUBLICATION OF THIS REPORT

| MEMBERS OF THE JSW MANAGEMENT BOARD | |

|---|---|

|

TOMASZ CUDNY President of the Management Board |

After graduation he worked at the Kazimierz-Juliusz mine in Sosnowiec, where he passed through all the professional career levels, from trainee to Manager of the Mining Works Department and Deputy Head of Mine Operations. He worked in mining development and decommissioning and reinforcement departments. He co-created the mining method for a strongly sloping coal seam and, together with a team, he worked out methods and possibility of maintaining roadway excavations adjacent to goafs. In 2007-2010, he worked as Chief Specialist in the Logistics and Tender Team in the Office of the Management Board of Katowicki Holding Węglowy S.A. (KHW S.A.). Later on, he held managerial positions in KWK Murcki-Staszic and KWK Wujek mines. In 2016, he became the President of the Management Board of Katowicki Holding Węglowy S.A. and in 2017, the President of the Management Board of Spółka Restrukturyzacji Kopalń S.A., where he worked until 2018. From 2019 to 2021, he served as President of the Management Board of TAURON Wydobycie S.A. He has been President of the Management Board of Jastrzębska Spółka Węglowa S.A. since 28 August 2021. |

|

WOJCIECH KAŁUŻA Vice-President of the Management Board for Development |

From 2018 to 2022, he was Deputy Marshal of the Silesian Voivodeship, overseeing the following Departments: European Funds, Regional Development and Transformation, Economy and International Cooperation, as well as Tourism and Sports. He has experience in both public and local government administration, as well as extensive managerial experience in commercial enterprises. He has been Vice-President of the Management Board for Development of Jastrzębska Spółka Węglowa S.A. since 15 December 2022.. |

|

SEBASTIAN BARTOS Vice-President of the Management Board for Sales |

He started his professional career in 1999 at the editorial office of the stock exchange newspaper “Die Telebörse” of the Handelsblatt Group in Frankfurt am Main. Associated with the Jastrzębska Spółka Węglowa S.A. Group since 2002. In the Sales Department of Polski Koks S.A. and later on in Jastrzębska Spółka Węglowa S.A. he worked his way up the career ladder from Sales Specialist to Director of the Coke and Hydrocarbons Sales Department. Since the beginning of his professional career in the Group, he has been associated with trade, working in managerial positions at various levels responsible for the sale of the Group’s products, i.e. coking coal, coke, hydrocarbons, steam coal, as well as logistics and market analysis. Participant and speaker of numerous specialist conferences on raw materials in Poland and abroad. He is fluent in German and English. Vice-President of the Management Board for Sales of Jastrzębska Spółka Węglowa S.A. since 30 July 2021. |

|

ROBERT OSTROWSKI Vice-President of the Management Board for Financial Matters |

After university, he worked for private funds in the mining industry. From 1998 to 2002, he was Finance Director at Huta Katowice S.A., from 2002 to 2006 he was Finance Director and Director of the Financial Projects Department at Mittal Steel Poland S.A. (previously: Huta Katowice S.A., Polskie Huty Stali S.A., now ArcelorMittal), from 2006 to 2008 he was Vice-President of the Management Board for Financial Matters and Finance at Jastrzębska Spółka Węglowa S.A., from 2008 to 2014 he was President of the Management Board of Minerals Mining Group S.A., from 2014 to 2015 he was a Member of the Management Board for Financial Matters at Polskie Koleje Linowe S.A. and Polskie Koleje Górskie S.A. From February 2016, he was a Member of the JSW S.A. Supervisory Board seconded to serve as a Member of the JSW S.A. Management Board and then from June 2016 to February 2019, he served as Vice-President of the Management Board for Financial Matters at JSW. In this period he was responsible for, among other things, developing the assumptions and implementing the financial restructuring plan for JSW and building a long-term financing structure based on the creation of the Closed-End Stabilization Investment Fund, the purpose of which was to support the Company’s current liquidity and reduce the impact of coal and coke price volatility risk on continuity of the Group’s operating and investment activity. He was also responsible for obtaining and finalizing long-term amortized and revolving bank financing. From 2019 to 2020, he served as President of the Management Board of PGE Górnictwo i Energetyka Konwencjonalna S.A. - the largest power producer in Poland covering over 39% of the demand for electricity. Then, from May 2020, he was President of the Management Board of Polskie Elektrownie Jądrowe Sp. z o.o. (previously PGE EJ 1 Sp. z o.o.). He has served as Vice-President of the Management Board for Financial Matters in Jastrzębska Spółka Węglowa S.A. since 3 August 2021. |

|

EDWARD PAŹDZIORKO Vice-President of the Management Board for Technical and Operational Matters |

From the outset of his career, he has been active in the mining industry. In 1992, he started working in the KWK “Wesoła” coal mine in Mysłowice, initially as an underground trainee, and then he worked his way up the supervisory ladder from the position of overman, through shift foreman, branch manager and mining foreman, to mining works manager and deputy chief mining engineer. While working at the “Wesoła” coal mine until 2007, he was also qualified as Head of Mine Operations. He gained his mining experience in areas of the greatest natural hazards, including methane, crumbling, fire and water hazards, managing large teams of people. He has also proven himself as a mine rescuer and managing direct rescue operations as an Operation Manager. In 2007-2008, he worked in mining supervision at KGHM Polska Miedź S.A.’s “Lubin” Mine. From 2008 to 2016 he worked at the KWK “Murcki-Staszic” mine owned by Katowicki Holding Węglowy S.A. (“KHW”), where, among other things, he worked as Chief Mining Engineer and, since 2015, as Technical Director of this mine. Since July 2016, working as the Chief Engineer at KHW, he participated in the preparations connected with the transfer of KWK "Śląsk" and KWK "Wieczorek” to Spółka Restrukturyzacji Kopalń S.A., and in the merger of KHW with the Polska Grupa Górnicza S.A. (“PGG”). After the incorporation of KHW into the PGG structures, he co-founded the Natural Hazards Department at the PGG Management Board. As of June 2017, he was the Director of the Mining Investment Works Department (ZGRI) at PGG. He supervised there, among others, the implementation of innovative directional drilling with the use of plunge engines used in the methane drainage from mines, as well as specialized the activity of the Mining Investment Works Department (ZGRI) in mining works required for the Company's mines. From December 2019 to 31 August 2021, he was Vice President of the Management Board for Technical Matters at TAURON Wydobycie S.A. In that period, he supervised and implemented a number of investment projects, important for the future existence of plants in the Company, including completion of the investment of development of the shaft-hoisting system in the “Janina” VI shaft with expansion of level 800 at KWK Janina, starting co-generation engines at KWK Brzeszcze, designing and making available a new “Dąb” area at KWK Sobieski. As a result, this translated into increasing and stabilizing the level of steam coal production of TAURON Wydobycie S.A. |

|

ARTUR WOJTKÓW Vice-President of the Management Board for Employment and Social Policy |

|

COMPENSATION SYSTEM FOR MANAGEMENT BOARD MEMBERS IN JSW

The rules governing the shaping of the compensation of Management Board members have been adopted by the JSW Shareholder Meeting and Supervisory Board in compliance with the regulations laid down in the Act of 9 June 2016 on the Rules for Shaping the Compensation of Persons Managing Certain Companies. and are consistent with the “Compensation Policy for the Management Board and Supervisory Board of Jastrzębska Spółka Węglowa S.A.” adopted by the Shareholder Meeting. Management contracts were concluded with Management Board Members providing for an obligation to act personally, regardless of whether they act within the framework of their own business activity. With the Management Board Members, no separate agreements were signed that would provide for compensation in the event of expiration of the Manager’s mandate.

The total remuneration for the Management Board Member is composed of the fixed part, constituting the monthly base salary –Fixed Compensation and variable part, constituting variable Remuneration for the Company’s financial year – Variable Compensation.

The amount of the monthly Fixed Compensation of Management Board Members has been set by the Supervisory Board, subject to the following provisions of the Shareholder Meeting resolution:

- Fixed Compensation of the President of the Management Board will be set within the range from 7 to 15 times the base amount referred to in Article 1 Section 3 Item 11 of the Act on the Rules for Shaping the Compensation of Persons Managing Certain Companies of 9 June 2016;

- Fixed Compensation of the remaining Management Board Members will be set within the range from 7 to 12 times the base amount referred to in Article 1 Section 3 Item 11 of the aforementioned Act.

In accordance with the decision made by the Supervisory Board, for rendering management services and discharging other obligations ensuing from the contract, the Manager is entitled to the Total Compensation consisting of the following:

- monthly base compensation (Fixed Compensation) per calendar month:

- President of the Management Board – PLN 60,000.00,

- every other Management Board Member – PLN 50,000.00.

The Fixed Compensation includes also compensation for the transfer of property rights to the copy or medium of the work and economic copyright to the work in the fields of use specified in the contract, granting all permits and authorizations to the extent stipulated in the contract and use by the Company of an invention, utility model or industrial design created by the Manager,

- supplementary compensation for the relevant financial year (Variable Compensation) contingent on the degree of achievement of the management objectives, which must not exceed 100% of the annual Fixed Compensation of the Manager in the previous financial year, for which the Variable Compensation is calculated.

A Management Board Member may not receive any compensation for serving as a member of any corporate body of the Company’s subsidiary within the Group within the meaning of Article 4(14) of the Competition and Consumer Protection Act of 16 February 2007.

The Fixed Compensation or Variable Compensation will be paid by the Company after deduction of the Manager’s public dues payable by the Company from the amount of the Fixed or Variable Compensation. If the applicable provisions of law require that, despite the fact that the Manager does not run his/her own business activity, the Fixed Compensation, the Variable Compensation or benefits payable by virtue of severance pay or non-competition clauses are subject to VAT at the applicable rate, such VAT will be added on top the amount in question. The above will be also applicable with regard to other benefits payable by the Company to the Manager pursuant to the contract. If it becomes mandatory for the Manager to pay VAT for any past periods (in connection with the benefits referred to in this Section), the Company undertakes to pay to the Manager the amount equivalent to such tax arrears with interest as well as other payments due to the relevant bodies in connection with such arrears.

The Fixed Compensation for a given month is paid within 7 days from the date of delivery to the Company of a correctly issued bill to be delivered to JSW by the Manager within 7 days upon end of the calendar month of performance of services, by transfer to a bank account indicated by the Manager.

The Variable Compensation depends on the level of achievement of the management objectives and must not exceed PLN 480,000.00 per financial year, i.e. no more than PLN 40,000.00 in each month of the financial year. The Manager will also be entitled to the Variable Compensation if he/she performs the contract for a period of less than one full financial year but at least for 3 months in the relevant financial year.

The total annual Total Compensation of the Manager (i.e. the sum of the annual Fixed Compensation and the Variable Compensation for the given financial year) must not exceed the product of the amount of PLN 100,000.00 for the President of the Management Board and PLN 90,000.00 for Vice-Presidents of the Management Board and the number of calendar months for which the Manager performed his/her duties. In case of calendar months in which the Manager did not perform his/her duties during a full calendar month, the aforementioned amount is adjusted on a pro rata basis to the number of days of performance of duties in the relevant month.

The statutory Management Objectives are laid down in Article 4(7) of the Act on the Rules for Shaping the Compensation of Persons Managing Certain Companies, and their accomplishment is the precondition that must be fulfilled to enable payment of the Variable Compensation for the respective financial year. Other than the statutory Management Objectives, general and additional Management Objectives are established by a resolution of the Shareholder Meeting.

The Company’s Supervisory Board establishes (by way of a resolution) detailed Management Objectives for the respective financial year and defines the weights for such objectives along with objective and measurable criteria of their accomplishment and settlement (KPIs) while giving consideration to the following:

- Variable Compensation is payable to the respective Management Board Member after the Management Board activity reports and the financial statements for the preceding financial year are approved and the Management Board Member is granted a discharge on the performance of his duties by the Shareholder Meeting.

- Payment of a portion of the Variable Compensation may be deferred for a period provided for in a resolution of the Shareholder Meeting, depending on the fulfillment of conditions by the specified deadline in accordance with the established Management Objectives. Then such portion of the Variable Compensation may be disbursed in full or in part at the end of the settlement period.

- The Variable Compensation is calculated on a pro rata basis. Such pro rata calculation depends on the number of days of the provision of services by the Management Board Member in the respective financial year.

- Satisfaction of the conditions for the Variable Compensation of individual Management Board Members for whom Management Objectives were set for the given financial year and who discharged a function in the financial year being assessed, is ascertained by the Supervisory Board by determining the amount due, on the basis of financial statements reviewed by an audit firm and other documents depending on the Objectives set.

The Supervisory Board each time adopts clear, comprehensive and diversified criteria for the adoption of weights for each of the Management Objectives in the Variable Compensation as well as objective and measurable criteria for their accomplishment and settlement, both in relation of the Company’s financial and non-financial performance. When establishing the detailed Management Objectives for the respective financial year, the Supervisory Board, taking into consideration the Company’s line of business, each time and to the greatest possible extent takes into account the public interest, the Company’s contribution to environmental protection and the taking of actions aimed at preventing and counteracting the adverse social effects of the Company’s business.

The Variable Compensation is paid subject to the accomplishment of the Management Objectives by the respective Manager, which is assessed by the Supervisory Board while giving consideration to the weights of these Objectives and the objective and measurable criteria of their accomplishment and settlement (KPIs). The Variable Compensation, provided that it is due, will be paid within 7 days from the date of delivery to the Company of a correctly issued bill by transfer to a bank account indicated by the Manager.

The Parent Company will be entitled to put forward a claim for reimbursement of the Variable Compensation paid if, following such disbursement, it becomes apparent that the Variable Compensation was granted to the Manager on the basis of data that subsequently turned out to be untrue.

In the case when the resolution of the Supervisory Board that defines the Management Objectives for the given year is not passed, the Management Objectives for such year are not set, and the Manager is not entitled to any Variable Compensation. Furthermore, in the cases laid down in the contract JSW may charge the Manager with a contractual penalty.

Management Board Members have the duty to obtain the Supervisory Board’s consent to assume, as planned, the function in corporate bodies of another commercial company, to perform work or provide services for other entities pursuant to an employment contract, mandate agreement or another legal relationship.

In 2022, in connection with the change in the term of office of the Management Board, the Supervisory Board adopted a resolution on the rules for defining the compensation of Management Board Members. The rules set by the Supervisory Board for defining the compensation of Members of the Management Board of the 11th term of office have not changed with respect to the rules in effect for the 10th term.

Table. MANAGEMENT BOARD COMPENSATION FOR 2022 (PLN)

| FIRST AND LAST NAME | PERIOD | COMPENSATION – MANAGEMENT SERVICES* | VARIABLE COMPENSATION FOR 2022** | BENEFITS, INCOME FROM OTHER SOURCES*** | TOTAL |

|---|---|---|---|---|---|

| Tomasz Cudny | 01.01.-31.12.2022 | 720 000,00 | - | - | 720 000,00 |

| Sebastian Bartos | 01.01.-31.12.2022 | 600 000,00 | - | - | 600 000,00 |

| Robert Ostrowski | 01.01.-31.12.2022 | 600 000,00 | - | 27 763,92 | 627 763,92 |

| Edward Paździorko | 01.01.-31.12.2022 | 600 000,00 | - | 5 000,00 | 605 000,00 |

| Artur Wojtków | 01.01.-31.12.2022 | 600 000,00 | - | - | 600 000,00 |

| Wojciech Kałuża | 15.12.-31.12.2022 | 28 333,33 | - | - | 28 333,33 |

| TOTAL | 3 148 333,33 | - | 32 763,92 | 3 181 097,25 |

* This item includes only the cost of compensation based on management contracts.

** This item includes variable compensation for 2022 which will be paid on condition that the Managers meet the Management Objectives in accordance with a resolution of the Supervisory Board, after The Management Board Report on the Activity of Jastrzębska Spółka Węglowa S.A. and the Jastrzębska Spółka Węglowa S.A. Group for the financial year ended 31 December 2022 and the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2022 are approved and the Management Board Members are granted a discharge on the performance of their duties by the Shareholder Meeting. As of the date of approval of this report by the Management Board, the Supervisory Board of JSW has not adopted a resolution regarding the estimated values of variable compensation for 2022. This information will be disclosed in the Report on compensations of JSW Management Board and Supervisory Board Members for the financial year ended 31 December 2022.

** * This item includes other benefits, such as: coverage (reimbursement) of costs incurred in connection with the use of the residential apartment (§ 4 sec. 1 item 5 of the management contract) and coverage of the costs of individual English lessons (Supervisory Board Resolution no. 506/X/2021 of 27 September 2021.

Table. MANAGEMENT BOARD COMPENSATION FOR 2021 (PLN)

| FIRST AND LAST NAME | PERIOD | COMPENSATION – MANAGEMENT SERVICES* | VARIABLE COMPENSATION FOR 2021** | BENEFITS, INCOME FROM OTHER SOURCES*** |

TOTAL |

|---|---|---|---|---|---|

| Tomasz Cudny | 28.08.-31.12.2021 | 248 000,00 | 129 900,00 | - | 377 900,00 |

| Sebastian Bartos | 30.07.-31.12.2021 | 253 333,34 | 132 700,00 | - | 386 033,34 |

| Robert Ostrowski | 03.08.-31.12.2021 | 246 666,66 | 129 200,00 | 8 473,30 | 384 339,96 |

| Edward Paździorko | 01.09.-31.12.2021 | 200 000,00 | 104 800,00 | 845,00 | 305 645,00 |

| Artur Wojtków | 01.01.-31.12.2021 | 600 000,00 | 314 300,00 | - | 914 300,00 |

| Włodzimierz Hereźniak | 01.01.-18.01.2021 05.05.-09.07.2021 |

146 000,00 | - | 124 000,00 | 270 000,00 |

| Jarosław Jędrysek | 10.05.-09.07.2021 | 101 666,67 | - | - | 101 666,67 |

| Barbara Piontek | 01.03.-09.07.2021 | 258 000,00 | 135 200,00 | - | 393 200,00 |

| Tomasz Duda | 01.01.-09.07.2021 | 315 000,00 | 165 000,00 | 300 000,00 | 780 000.00 |

| Artur Dyczko | 01.01.-29.03.2021 | 148 333,33 | - | 307 676,80 | 456 010,13 |

| Radosław Załoziński | 01.01.-29.03.2021 | 148 333,33 | - | 300 000,00 | 448 333,33 |

| TOTAL | 2 665 333,33 | 1 111 100,00 | 1 040 995,10 | 4 817 428,43 |

* This item includes only the cost of compensation based on management contracts.

** The variable compensation for 2021 in the item includes the estimated values adopted by the JSW Supervisory Board on 14 April 2022 with Resolution No. 596/X/22, which had not been paid by the date of approval of this report. Annexes to management contracts were concluded with the Management Board Members serving for at least 3 months in 2021, in which it was agreed that the Supervisory Board would adopt a resolution on the implementation of Management Objectives for the financial year ended 31 December 2021 and the determination of the amount of Variable Compensation due for payment, by 31 March 2023.

*** This item includes benefits payable after the expiration of the management contract (severance pay, compensation for refraining from competitive activity) and/or other benefits e.g. reimbursement of apartment rental fee.

Table. COMPENSATION OF THE SUPERVISORY BOARD MEMBER SECONDED TO TEMPORARILY PERFORM THE DUTIES OF THE VICE-PRESIDENT OF THE MANAGEMENT BOARD IN 2021 (PLN)

| FIRST AND LAST NAME | PERIOD |

COMPENSATION – MANAGEMENT SERVICES* |

VARIABLE COMPENSATION FOR 2021 | BENEFITS, INCOME FROM OTHER SOURCES | TOTAL |

|---|---|---|---|---|---|

| Stanisław Prusek | 09.07.-28.08.2021 | 96 774,19 | - | - | 96 774,19 |

| Michał Rospędek | 09.07.-30.07.2021 | 35 483,87 | 35 483,87 | ||

| TOTAL | 132 258,06 | - | - | 132 258,06 |

With a statement of expenses being submitted, the variable compensation for 2020 (charged to costs of 2020) granted by the decision of the Supervisory Board was also paid in 2022:

- to Mr. Radosław Załoziński in the amount of PLN 30,000.00,

- to Mr. Artur Dyczko in the amount of PLN 30,000.00.

Zgodnie z obowiązującą od 31 sierpnia 2020 roku Polityką Wynagrodzeń Zarządu i Rady Nadzorczej Jastrzębskiej Spółki Węglowej S.A. Członek Zarządu nie może pobierać wynagrodzenia z tytułu pełnienia funkcji członka organu w podmiotach zależnych od Spółki w ramach Grupy.

COMPENSATION SYSTEM FOR MEMBERS OF THE MANAGEMENT BOARDS OF GROUP COMPANIES

The rules governing the determination of compensations of the Management Board Members of JSW subsidiaries have been adopted by way of resolutions of the General Meeting or Shareholder Meeting of the respective company, and then resolutions of the relevant Supervisory Board. The total compensation of the Management Board Members consists of a fixed component constituting his or her monthly base salary and a variable component constituting additional compensation for the Company’s financial year. The variable portion depends on the level of achievement of the management objectives. The Management Board Members of the subsidiaries of JSW executed contracts for provision of management services.

Since 7 December 2021, the Compensation Policy for Corporate Bodies of JSW’s Subsidiaries has been in force in the Group, which updates prior regulations pertaining to the compensation of the corporate bodies of JSW’s subsidiaries. This update was associated with implementing different regulations pertaining to JSW’s key employees (a distinct Compensation Policy for JSW’s Management has been adopted in this respect) from the regulations pertaining to the compensation of the corporate bodies of JSW’s subsidiaries. The JSW Management Board’s control over the compensation paid to members of the subsidiaries’ corporate bodies has been extended in addition to specifying hitherto solutions in greater detail.

NON-COMPETITION OBLIGATION WITH RESPECT TO MANAGERS IN THE PARENT COMPANY

The non-compete clause during the contract term has been defined in the management contract and the Manager is not entitled to any additional compensation for refraining from competitive activity during the contract term. The management contracts signed with the Management Board Members also include provisions prohibiting competition after the contract termination.

The Manager additionally undertakes, after the contract is terminated, if he has discharged the function for a period of at least 6 months from the date of the Manager’s appointment to the Company’s Management Board, not to conduct any competitive activity as defined in the contract over the period of 6 months from the date he/she ceases to perform his/her function. The Manager is entitled to compensation for complying with the non-compete ban after the function ends, in the total amount equal to 6 times 50% of the monthly Fixed Compensation. The compensation will be payable in 6 equal monthly installments, by the 10th day of the following month. The compensation payment is conditional upon a written representation of the Manager confirming compliance with the non-compete clause after the function ended, delivered to the Company in writing by the 5th day of the month following the month for which the compensation is due.

A management contract may be terminated, after the function ends, in the part concerning the non-compete clause at any time by virtue of an agreement of the Parties. The agreement must be executed in writing, otherwise being null and void, and must define the notice period which may not be longer than 3 months or be later than the end of the non-compete obligation after the function ends. In such a case, the entitlement to compensation expires on the day the contract is terminated in the relevant scope. The contract may be also terminated in the part concerning the non-compete clause with immediate effect at any time upon the Company’s notice in the event of a documented violation of the no-compete clause by the Manager after his/her function ends. The contract termination notice must be in writing, otherwise being null and void, and the right to receive compensation expires on the date the notice of termination of the non-compete clause after the function ends is delivered to the Manager, with immediate effect.

In the event of expiry of the non-compete clause after expiry of the function and in the event of termination of the contract, on the terms laid down in the contract, the monthly installment of the compensation for such month will be decreased to the amount following from division of the monthly installment amount by 30 days and multiplying it by the number of days on which the non-compete clause applied after expiry of the function in such month.

The non-competition obligation after the function ends does not apply if, before the end of the term of the non-compete ban, the Manager undertakes to perform a function in a company mentioned in Article 1 Section 3 Item 7 of the Act of 9 June 2016 on the Rules for Shaping the Compensation of Persons Managing Certain Companies, or in the Company’s subsidiary in the Group within the meaning of Article 4 Item 14 of the Act of 16 February 2007 on Competition and Consumer Protection, or undertakes to work or provide services to such company pursuant to an employment contract, mandate contract, work product contract or otherwise. In such a case, the entitlement to compensation expires on the day the Manager takes up the function, undertakes to work or provide services for the benefit of such company.

If the non-compete clause is breached after expiry of the function during its term (subject to a reservation that the taking up of a function as referred to above is not considered a breach of the non-compete clause, provided that the Company is informed thereof in advance), the ban ceases to apply and the Company may demand the Manager to pay a contractual penalty in the amount of 100% of the total amount of compensation within 14 days of receipt of the Company’s demand to the bank account specified by the Company. The payment of contractual penalty shall not preclude the Company’s right to pursue damages in excess of the contractual penalty on general terms. The execution of a non-competition agreement after the termination of the contract for the provision of management services is unacceptable.

NON-COMPETITION OBLIGATION WITH RESPECT TO MANAGERS IN THE GROUP COMPANIES

The non-compete clause applicable during the term of provision of management services by a Management Board Member of a subsidiary of the Group is established in the contract for the provision of management services. The Management Board Members are not entitled to any additional compensation for refraining from competitive activity. The management contracts signed with the Management Board Members also include provisions prohibiting competition after the contract termination. This prohibition prevails under the condition the Management Board Member has discharged the function for a period of at least 6 months from the date of the Management Board Member’s appointment to the Company’s Management Board over the period of 4 months from the date he/she ceases to perform his/her function. The Management Board Member is entitled to compensation for complying with the non-competition ban after the function ends. The non-compete clauses in the contracts for the provision of management services are compliant with the regulations laid down in the Act on the Rules for Shaping the Compensation of Persons Managing Certain Companies of 9 June 2016 and the resolutions of the General Meetings/Shareholder Meetings of the Group companies on the rules governing the determination of remunerations of the Management Board Members.

NON-FINANCIAL COMPENSATION COMPONENTS DUE TO THE PARENT COMPANY’S MANAGEMENT BOARD MEMBERS

The non-financial compensation components due to Management Board Members comprise:

- providing the Management Board Member, at the Company’s expense, with technical equipment and resources such as: office space together with equipment, laptop with wireless Internet access and other necessary equipment, means of communication, including mobile phone, car to be used by the Manager for private purposes on the rules set separately by the Supervisory Board, however if the Manager uses a dwelling on the rules following from the contract, then if, on the days when services are performed in the Company’s seat, the Manager drives to the place of residence and back in a vehicle provided by the Company, then the Manager will be charged a fee of PLN 400 per ride (to the place of residence or back), dwelling, provided that the Manager has a place of residence that is more than 100 km away from the Company (in such case the Company will cover the costs associated with the use of the dwelling up to PLN 2,500.00 per calendar month net, i.e. without the VAT),

- covering or reimbursing costs related to the provision of services by Management Board Members, including those provided outside the Company’s premises, necessary for the proper performance of services, in particular, such as the costs of travel and accommodation,

- covering or reimbursing, with the Supervisory Board’s consent, other costs related to the provision of services to the extent resulting from the contract for the provision of management services,

- covering or reimbursing expenses incurred and necessary for the proper provision of services in accordance with a standard appropriate to the function discharged, after they have been properly documented and their incurrence has been justified, including by demonstrating the connection with and need for the proper provision of services,

- covering or reimbursing costs of the Manager’ individual training associated with the subject matter of the contract and the Manager’s contractual obligations up to PLN 20,000 per calendar year of the term of the contract.

During the term of the contract, the Manager may use other benefits, in particular those provided by the Company for the Company’s management staff, provided that the Supervisory Board, by way of a resolution, establishes the rules for granting or using such benefits by the Manager.

During the term of the management contract the Supervisory Board allows the possibility of using the assigned company cars for the Managers’ private purposes on the rules laid down in the contract. The use of the company car for private purposes is paid for. The compensation referred to above is not charged if the Manager, by the deadline for submission of the bill for the provision of management services for a given month, submits a statement that the company car was not used for private purposes during that month.

The Supervisory Board granted each Management Board Member the right to be insured against liability for the function discharged. In each financial year, a Management Board Member is entitled to a paid break in the provision of management services.

INFORMATION ON ANY LIABILITIES UNDER PENSIONS AND SIMILAR BENEFITS

By virtue of the discharge of the functions entrusted to them, JSW Management Board Members and Supervisory Board Members are not entitled to participate in any retirement and disability or early retirement plans, except for Supervisory Board Members appointed by employees who are entitled having their contribution resulting from the employment relationship with JSW transferred to the Employee Pension Plan.

Management service contracts entered into with Members of the Group companies’ Management Boards do not contain the provisions concerning liabilities under pensions and similar benefits.

Powers of the JSW Supervisory Board

Powers of the Supervisory Board are set forth in the Articles of Association. In performance of its duties, the Supervisory Board also follows the guidelines of the Prime Minister contained in the document entitled Principles of Ownership Supervision over Companies with State Treasury shareholding, and the rules included in the 2021 Code of Best Practice for WSE Listed Companies.

MATTERS REQUIRING RESOLUTIONS BY THE SUPERVISORY BOARD:

- approving the Management Board Bylaws and issuing an opinion on the Organizational Bylaws defining the organization of the Company’s enterprise,

- appointing and dismissing the Company’s Management Board Members, without prejudice to § 11 section 5 of the Articles of Association,

- suspending a Management Board Member or the entire Management Board from performing its duties for important reasons by secret ballot,

- delegating any Supervisory Board Member or members to temporarily perform the duties of those Management Board members who are unable discharge their functions,